Page 2 of 3

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 1:00 pm

by Trades with cats

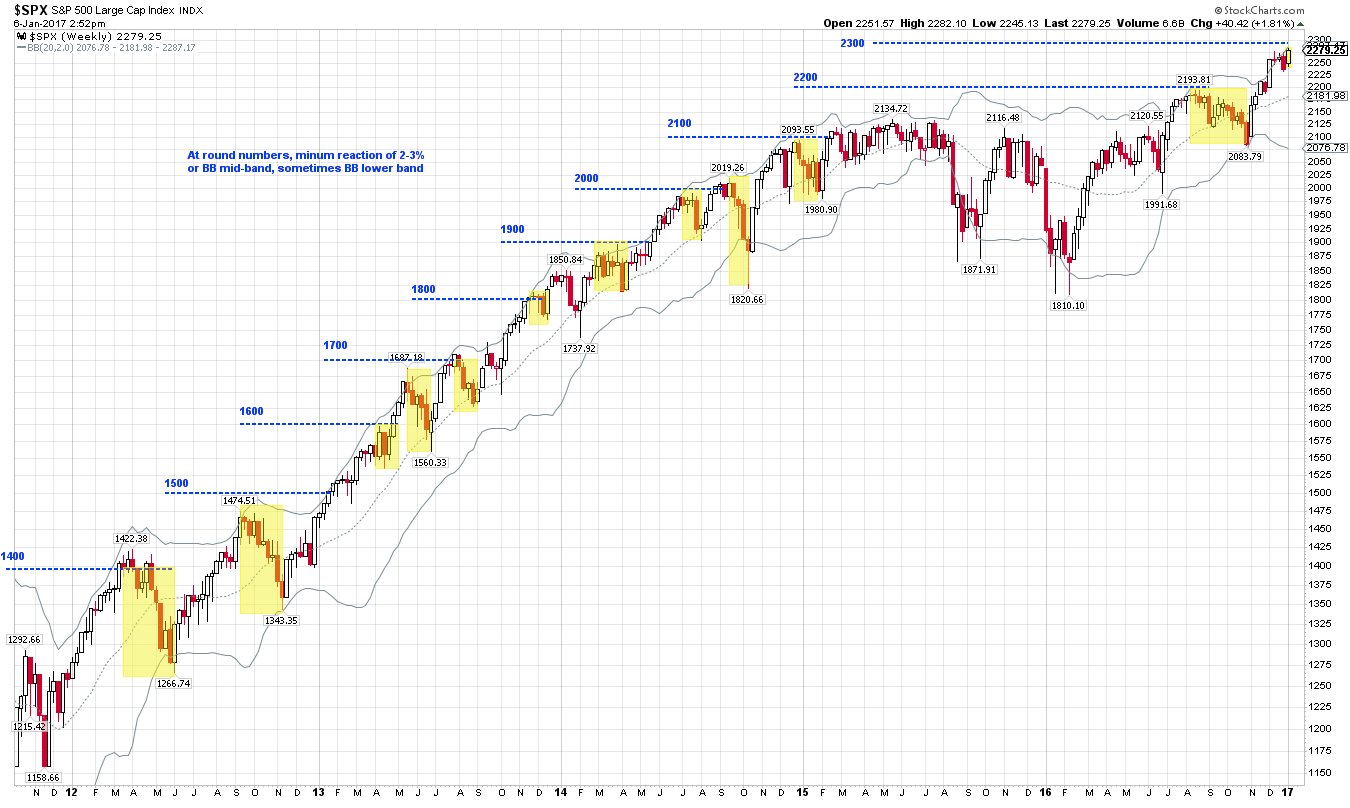

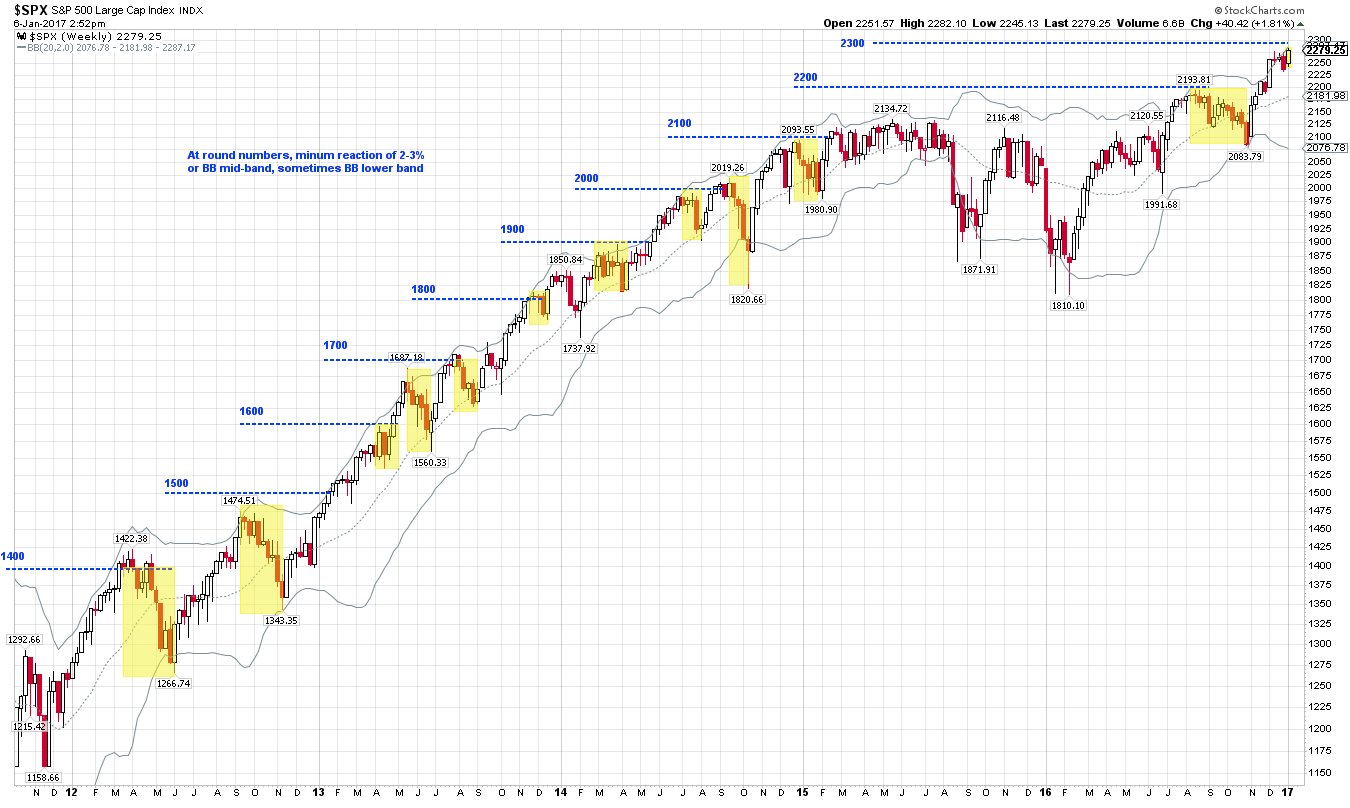

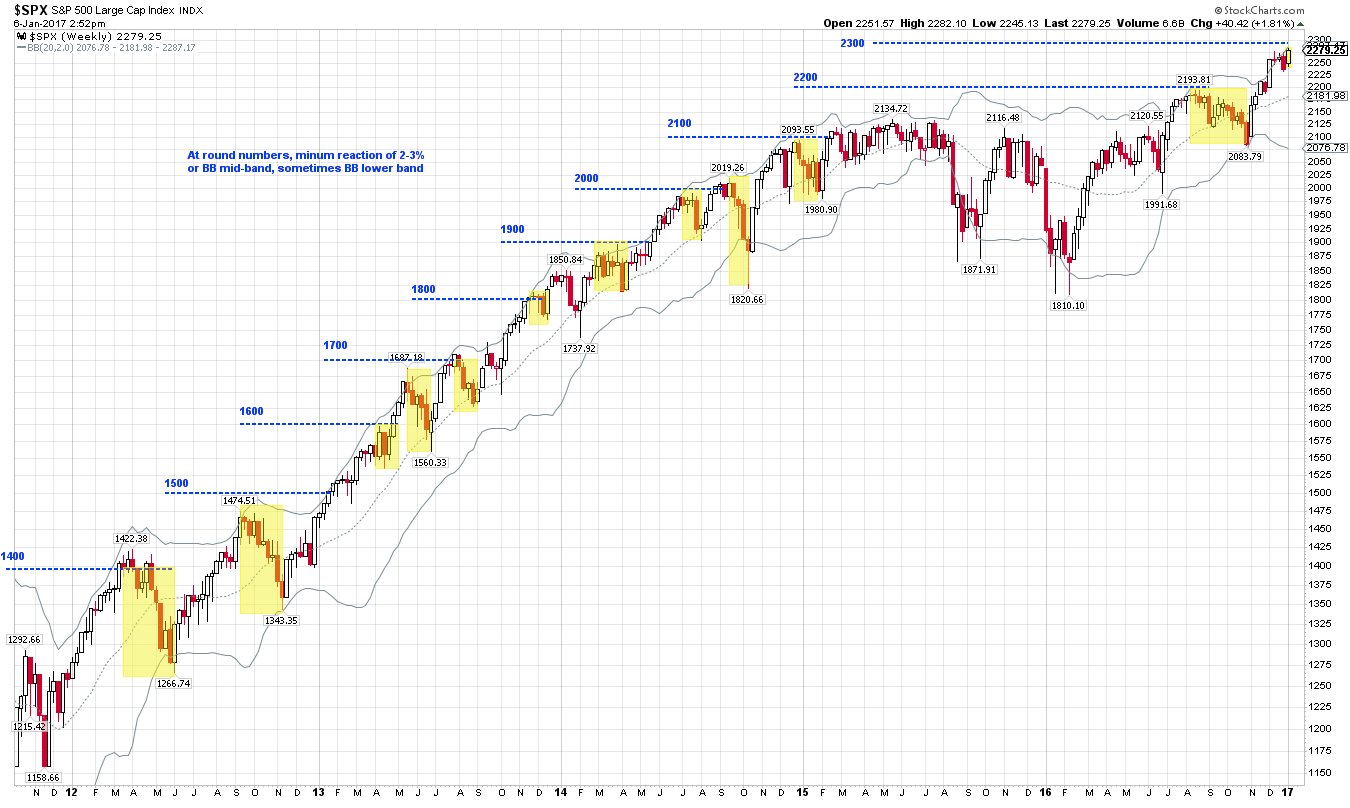

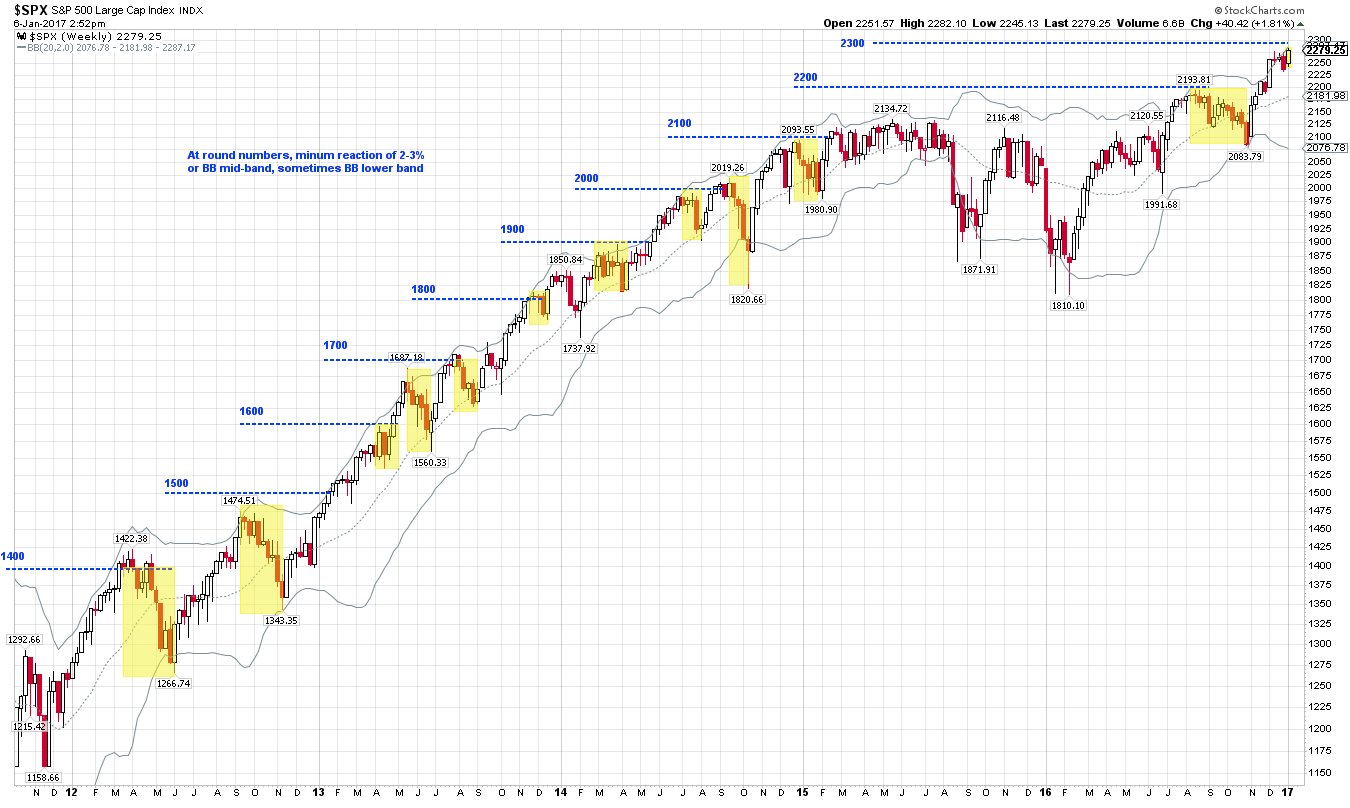

Urban Camel tweeted this morning a big history chart. Bollinger shows we should be hitting a pull back. I would point out that outside of the Swiss National Bank (largest holder of Facebook) ECB and buybacks seem to be the main source of cash. Buybacks about to be shut off for earnings and ECB is about to taper (so it is claimed). All aligns with typical new president running out of fairy dust. But who knows, maybe Trump will go way beyond the Dot com and 1929 valuation records.

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 1:13 pm

by JFR

Trading range. Back later ...

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 1:31 pm

by Al_Dente

Trades with cats wrote:Urban Camel tweeted this morning a big history chart. Bollinger shows we should be hitting a pull back. I would point out that outside of the Swiss National Bank (largest holder of Facebook) ECB and buybacks seem to be the main source of cash. Buybacks about to be shut off for earnings and ECB is about to taper (so it is claimed). All aligns with typical new president running out of fairy dust. But who knows, maybe Trump will go way beyond the Dot com and 1929 valuation records.

thanks boss

your charts often cut off the right-hand side (the current stuff)

better to add link?

https://twitter.com/@ukarlewitz

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 1:32 pm

by KENA

Trades with cats wrote:Urban Camel tweeted this morning a big history chart. Bollinger shows we should be hitting a pull back. I would point out that outside of the Swiss National Bank (largest holder of Facebook) ECB and buybacks seem to be the main source of cash. Buybacks about to be shut off for earnings and ECB is about to taper (so it is claimed). All aligns with typical new president running out of fairy dust. But who knows, maybe Trump will go way beyond the Dot com and 1929 valuation records.

Your long term chart looks like it could set up into a perfect dome. We will just have to wait and see.

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 1:53 pm

by fehro

fehro wrote:"IF" SPX can't fill morning gap ...looking to Jan 3rd gap fill to 2248 with green 60m bull flag support near 20d SMA at 2260 key level today

chopping around trying to fill the gap.. VIX backs off.

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 2:10 pm

by Trades with cats

Big charts imported from other sources seem to need a zoom adjustment down to 80% or so to see the whole thing. I will include a link as I am already pasting it anyway. I thought his view that even numbers frequently lead to pull backs was interesting. What I would prefer to see is that composite of world wide central bank money creation on the same scale.

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 2:25 pm

by Trades with cats

This is the chart I am talking about. This one was from last summer. Citi research creates them.

https://realinvestmentadvice.com/wp-con ... uidity.jpg

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 2:29 pm

by BullBear52x

going to today's T2 (2265)

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 2:31 pm

by BullBear52x

short term sideways trading range.

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 2:40 pm

by BullBear52x

Al_Dente wrote:Trades with cats wrote:Urban Camel tweeted this morning a big history chart. Bollinger shows we should be hitting a pull back. I would point out that outside of the Swiss National Bank (largest holder of Facebook) ECB and buybacks seem to be the main source of cash. Buybacks about to be shut off for earnings and ECB is about to taper (so it is claimed). All aligns with typical new president running out of fairy dust. But who knows, maybe Trump will go way beyond the Dot com and 1929 valuation records.

thanks boss

your charts often cut off the right-hand side (the current stuff)

better to add link?

https://twitter.com/@ukarlewitz

Right mouse click ======> open the image in new tap (Chrome)

will open up the whole image.

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 3:03 pm

by Al_Dente

BullBear52x wrote:Right mouse click ======> open the image in new tap (Chrome)

will open up the whole image.

THANKS BOSS

that works 4 me

ELSEWHERE:

Zoom on IWM daily

Right there testing all the bottom lines

BUT sell-volume has dissipated in the last three days (three days of price down, three days of reduced selling volume). That’s bullish

BUT MUST SEE END OF DAY VOLUME. If selling volume is truly drying up, then Oy

To paraphrase Al Brooks: It’s not a breakdown until it breaks down

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 3:06 pm

by QED

Al_Dente wrote:Trades with cats wrote:Urban Camel tweeted this morning a big history chart. Bollinger shows we should be hitting a pull back. I would point out that outside of the Swiss National Bank (largest holder of Facebook) ECB and buybacks seem to be the main source of cash. Buybacks about to be shut off for earnings and ECB is about to taper (so it is claimed). All aligns with typical new president running out of fairy dust. But who knows, maybe Trump will go way beyond the Dot com and 1929 valuation records.

thanks boss

your charts often cut off the right-hand side (the current stuff)

better to add link?

https://twitter.com/@ukarlewitz

Better link:

Weekly Market Summary

http://fat-pitch.blogspot.com/2017/01/w ... mmary.html

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 3:15 pm

by Trades with cats

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 3:16 pm

by fehro

SPX still sloppy.. possible H&S in there.. still about the gaps.. and 20d 2262.

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 3:17 pm

by Al_Dente

thanks boss

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 3:18 pm

by BullBear52x

Al_Dente wrote:BullBear52x wrote:

ELSEWHERE:

Zoom on IWM daily

Right there testing all the bottom lines

BUT sell-volume has dissipated in the last three days (three days of price down, three days of reduced selling volume). That’s bullish

BUT MUST SEE END OF DAY VOLUME. If selling volume is truly drying up, then Oy

To paraphrase Al Brooks: It’s not a breakdown until it breaks down

The attachment 19day.png.png is no longer available

A shakeout could be very deep to stay sober

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 3:36 pm

by Al_Dente

BullBear52x wrote: A shakeout could be very deep to stay sober

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 3:56 pm

by BullBear52x

Chart for the road: Distribution is getting stronger once again, 5/20 DMA support is key this week. Peace!

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 4:01 pm

by Al_Dente

HAPPY HOUR

Re: 01/09/2017 Live Update

Posted: Mon Jan 09, 2017 4:15 pm

by Al_Dente

New highs ATH earlier today QQQ, $COMPQ, AAPL