Page 1 of 3

08/10/2017 Live Update

Posted: Thu Aug 10, 2017 9:20 am

by Cobra

If you're StockCharts member, please do me a little favor by "vote" and the most importantly "follow" my public chart list HERE. You need "follow" only once but vote can be done everyday, so whenever you have time, please vote for me, thanks! If you're not StockCharts member, you can also help boosting my rank by clicking the link once everyday.

- Please, again, all my calls in the daily live update is for intra-day only, they're absolutely invalid when the closing bell rings. If you're interested in the forecast for days and weeks, Please subscribe my Daily Market Report.

- Personal attack on any board members won't be tolerated. Please limit your topic to trade related only.

- Please no direct link to your personal web site or blog. You must post rich contents here. You can, however, put link to your personal web site or blog as your signature.

- I'm very busy during the trading hour, so your question posted on board might not be answered. For a guaranteed answer to your question please send email to info@cobrasmarketview.com.

=============================================================================================================================================================================

double bottom or not, wait and see.

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 9:24 am

by Cobra

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 9:32 am

by Wallstreetrader

Will be back at end of the day vix +38% omg !!!

"Strike plan 'ready within days"

by CNN

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 9:58 am

by fehro

SPX 50d zoo close 2448.50ish.. looking for 2450ish…. may stall bounce here. .not sure..

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:06 am

by Trades with cats

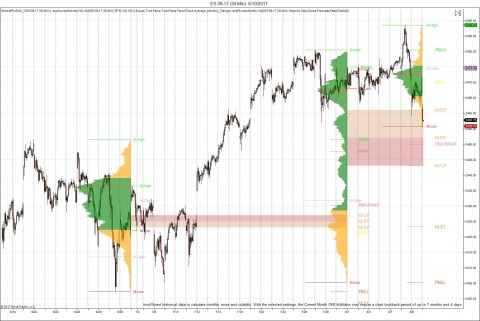

- 30 minute with monthly volume profile

Stepping back and looking at the larger picture all that low volume overnight gap and go growth is looking pretty weak. Don't see any convincing volume until 2435 or so.

Those are monthly pivots. No idea if they are helpful or not. But the color banding around the central pivot zone is directly related to the volume profile story.

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:10 am

by Al_Dente

OEX sorted by biggest reds today

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:11 am

by Trades with cats

If you are flying with Small Cap Airlines please keep your seat belt fastened at all times as we are hitting 5 handle air pockets!

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:12 am

by fehro

[quote="Wallstreetrader"

by CNN[/quote]

need a better news source…

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:16 am

by Wallstreetrader

fehro wrote:[quote="Wallstreetrader"

by CNN

need a better news source…

[/quote]

spiritual green light from good to nuke nk

do you need source ?

btw in these crazy days who trade it ?

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:16 am

by Al_Dente

NOT THE REGULAR HEAT MAP

This one is all ETFs

INCLUDING THE INVERSE ETFs

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:17 am

by fehro

RUT

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:24 am

by Al_Dente

VIX at 14

up >26%

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:29 am

by Trades with cats

ES Average Daily Range (20 day) 10.5

TF Average Daily Range (20 day) 12.7

So both are "limit" down" from the open. In the six months or so I have been using this indicator I have not seen a day that closed outside of it. Last week ES went below by about five handles, but came back before the close.

Not forecasting that the low for the day is in, just saying a lower low would be unusual. However with the VIX doing what it is could be some potential hedge fund margin calls coming, in which case all bets are off on normal behavior.

If I had the time would love to run stats on days when the funds were puking up a lung, er I mean reducing leverage.

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:33 am

by Wallstreetrader

(dax)longs reopen again, before next drop will stay a little more time on these...

Dax is crazy

*major trend is bear

Not recommended for heart sufferers

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:35 am

by brokebybernacke2

Trades with cats wrote:ES Average Daily Range (20 day) 10.5

TF Average Daily Range (20 day) 12.7

So both are "limit" down" from the open. In the six months or so I have been using this indicator I have not seen a day that closed outside of it. Last week ES went below by about five handles, but came back before the close.

Not forecasting that the low for the day is in, just saying a lower low would be unusual. However with the VIX doing what it is could be some potential hedge fund margin calls coming, in which case all bets are off on normal behavior.

If I had the time would love to run stats on days when the funds were puking up a lung, er I mean reducing leverage.

yes, bulls should test water at these levels...

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:51 am

by Al_Dente

At 10:06 am ET

NY TICK hit -1000 before it bounced

That’s extreme in my book

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:53 am

by brokebybernacke2

brokebybernacke2 wrote:Trades with cats wrote:ES Average Daily Range (20 day) 10.5

TF Average Daily Range (20 day) 12.7

So both are "limit" down" from the open. In the six months or so I have been using this indicator I have not seen a day that closed outside of it. Last week ES went below by about five handles, but came back before the close.

Not forecasting that the low for the day is in, just saying a lower low would be unusual. However with the VIX doing what it is could be some potential hedge fund margin calls coming, in which case all bets are off on normal behavior.

If I had the time would love to run stats on days when the funds were puking up a lung, er I mean reducing leverage.

yes, bulls should test water at these levels...

gotta get above 2460 for starters...

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:53 am

by Al_Dente

Bear still strong

I need it to hold above 2x

NY declining stocks = 4.4 x advancing stocks

NY declining volume = 2.8 x advancing volume

Nasdaq declining stocks = 3.1 x advancing stocks

Nasdaq declining volume = 2.7 x advancing volume

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:55 am

by Al_Dente

Re: 08/10/2017 Live Update

Posted: Thu Aug 10, 2017 10:59 am

by Trades with cats

Half hour to go then those negative Europeans go home and we are clear to begin the upwards New York drift!