Page 1 of 4

02/07/2018 Live Update

Posted: Wed Feb 07, 2018 10:22 am

by Cobra

If you're StockCharts member, please do me a little favor by "vote" and the most importantly "follow" my public chart list HERE. You need "follow" only once but vote can be done everyday, so whenever you have time, please vote for me, thanks! If you're not StockCharts member, you can also help boosting my rank by clicking the link once everyday.

- Please, again, all my calls in the daily live update is for intra-day only, they're absolutely invalid when the closing bell rings. If you're interested in the forecast for days and weeks, Please subscribe my Daily Market Report.

- Personal attack on any board members won't be tolerated. Please limit your topic to trade related only.

- Please no direct link to your personal web site or blog. You must post rich contents here. You can, however, put link to your personal web site or blog as your signature.

- I'm very busy during the trading hour, so your question posted on board might not be answered. For a guaranteed answer to your question please send email to info@cobrasmarketview.com.

=============================================================================================================================================================================

3 push up, the current rebound must be strong otherwise we'll see a pullback.

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 10:26 am

by Cobra

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 10:39 am

by Trades with cats

FT 71 showed the big resting orders at ES 2,700 from yesterday and last night. 1,200 contracts and another 500 just above. Will take a while to chew through those.

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 10:42 am

by Trades with cats

So much for that information!

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 10:44 am

by Trades with cats

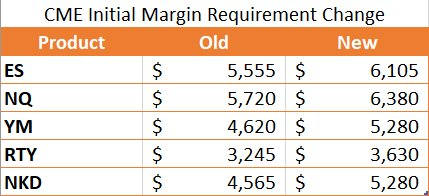

- margins.png (89.11 KiB) Viewed 3104 times

Horse running down the lane, quick better close that barn door.

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 10:51 am

by JFR

Looks like another wild ride today. Tick, Tick ...

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 10:56 am

by te_fern

VIX is still high, but seems to settling down. At least for right now!!

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 10:57 am

by te_fern

TICK is above its MA line, but not doing much right now. Market seems to be waiting.....

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 10:58 am

by Trades with cats

Part of the chat this morning was the observation that the market had about 15% of normal order depth but lots of volume as longer time frame traders were in charge. Which is way the very large very fast runs. Bill Bane's morning porridge said it was the hedge funds as most sat on their hands.

Makes reasonable sense to me that the hedge funds were jumping in yesterday. What was unsaid is just how much more do they have to deploy and does yesterday's action change the calculus for the pension and risk parity funds that are supposed to be reducing leverage over the next several days?

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 11:00 am

by Cobra

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 11:14 am

by Trades with cats

So around 6 am Eastern the market decided time to go with an over 20 point run up to the cash open. A brief pause, then a 28 point run in 15 minutes and now just drifting. If this thing runs out of buyers the middle of the action overnight was around 2683 and if that fails yesterday's value range of 2660 to 2620. Then the 2500's are a real possibility. If the more conservative money managers continue to sit on their hands and leave this to the hedge funds and all us shallow pocket short time frame types.

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 11:16 am

by fehro

come to papa… 50d 2720ish .. almost there.. 5 points look for a stall SPX

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 11:19 am

by Trades with cats

What did FOMC's Evans say to generate red bars?

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 11:21 am

by Al_Dente

2/6 NY new lows 479 (bottom zone, possibly just interim bottom)

2/5 NY new lows 452 (Monday, dow down -1178 points). When was the last time we had so many lows? Feb 2016

2/2 NY new lows 338 (Friday, dow down -666 points)

2/1 NY new lows 131

1/31 NY new lows 114

1/30/ NY new lows 251

1/29 NY new lows 204, the warning signal

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 11:23 am

by Al_Dente

NY advancing stocks = 2.4 x declining stocks

NY advancing volume = 3.0 x declining volume

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 11:25 am

by te_fern

Still above VWAP, but still watching..... Agree with TWC about the uncertainty of who is going to play in this market....

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 11:36 am

by Al_Dente

Easy on the eyes

A few favorite ETFs, longs (solid lines) and shorts/inverse (dashed lines)

ALL LEVERAGED, performance, 5 days

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 11:36 am

by Trades with cats

My software has ES VWAP at 2701.50. My price at volume software has Point of Control at VWAP. Translation, if this doesn't hold we will be exploring the downside. First two micro targets, yesterday's high at 2,700 then bottom of the 70% range on today (value area) 2697.25.

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 11:41 am

by Al_Dente

SMALLS

This point in the SML highs and lows (bottom panel) has marked significant turns lately

Daily chart

Re: 02/07/2018 Live Update

Posted: Wed Feb 07, 2018 12:04 pm

by Al_Dente

"They" are also using TVIX as well as UVXY

both about 20million shares already

and SVXY inverse

(XIV is the cockroach)