Page 2 of 3

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 12:57 pm

by Trades with cats

All in June ES

60 minute OR low 2732

Yesterday's close 2727.75

Target low 2726

Overnight Low 2724.25

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 1:00 pm

by Cobra

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 1:20 pm

by Cobra

my guess. I don't see real bears so far, so far.

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 1:22 pm

by Al_Dente

“…maybe not today but soon and for the rest of your life…” [Rick to Ilsa]

QQQ approaches “knock three times,” where odds favor a breakout

(we need better than 170.95, the ATH from 1/26)

If Q can do it, it will be the first of the majors to NEW HIGH

But it must be sticky.

No traps.

60m

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 1:34 pm

by Al_Dente

Bloomberg believes the small-caps outperformance is because they have less exposure to international markets, hence less impact of pending tariffs

[earlier this morning]

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 2:03 pm

by daytradingES

Trades with cats wrote:

So if you don’t trade futures let me do the math for you. 32 contracts at $50 per point means $1,600 per point, so if it gets to 42 he will be up $23,600.

It is always interesting to watch a heavy hitter roll.

How do you know he trades 32 contracts, TWC?

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 2:23 pm

by Trades with cats

daytradingES wrote:

How do you know he trades 32 contracts, TWC?

Sorry, he uses a short form notation. His last comment " long now at 2727.25 x 32. ".

Over the years, and earlier this week, he has posted his brokerage statement. He has also commented that in the past when he traded for a big firm it was 100 contracts at a time. So he has had years to develop what are to me nerves of steel. I could not handle watching today's little ripples if I knew each one was $20,000.

Anyway he posts his wave counts and then he trades them which makes him a very rare bird in wave counting.

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 3:01 pm

by Cobra

possible double bottom.

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 3:03 pm

by Al_Dente

3:30 ET he is supposed to sign a tariff thing

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 3:24 pm

by Trades with cats

Yes, but now being sold as "more ceremonial". Biggest issue for Wall Street in this mess is who replaces Cohen. Media saying it looks like the anti-globalist pro tariff crowd are maneuvering for the position.

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 3:32 pm

by Al_Dente

oil is short today

is that why spy is dragging its arse

???

idk

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 3:39 pm

by Cobra

so far goes as i guessed. although I guessed higher low the reality was lower low.

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 4:03 pm

by Al_Dente

Mexico, Canada exempted indefinitely from metals tariffs

all countries can negotiate exclusions

[Bloom, just now]

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 4:04 pm

by Cobra

this bull shall have legs.

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 4:07 pm

by Al_Dente

HAPPY HOUR

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 4:10 pm

by Trades with cats

I think the marginal players in oil are the hedge funds, or more accurately managed commodity accounts. Leverage off is leverage off, but there are so many cross currents in bonds and currencies that I don't think it shows as much. In Equities you really see it in tech with all those hedge fund hotel stocks, most of which are headquartered in California which is why that is such a great term.

So oil is stalling after a multi-month run up. Inventory numbers are less incitefull as it is the end of a cold winter and the producers are all dumping winter blend and starting the rolling switch to summer. Thrown in expanding shale production, expanding exports to China, the rapid changes in the middle east and it just may make sense to take profits and wait for things to shake out.

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 4:23 pm

by Trades with cats

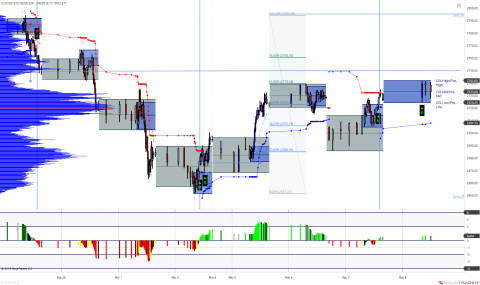

- 30,000 tick ES

This is a fake 15 minute chart. The 30,000 tick bars have been close to the 15 minute daily count. This is a new style for me where you don't have forced equidistant bar spacing. I think it gives a better read on overnight action. I added overnight and opening range so it would be clear when regular trading hours were, and of course with the futures roll that is messed up today.

I think it is very clear that a good number tomorrow and we could easily blow past this range on the way up. For today 2750 was the upside target.

Bad number tomorrow and that POC for the entire selloff at 2720 would be the first obvious rest then easily back to the double digit at 2700 and a retest of the 2650 ish low is on for next week. Or maybe we get nothing and this thing just continues to coil in the range.

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 4:31 pm

by Trades with cats

Headed down to VWAP at 2735 ES 06-18

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 4:48 pm

by Cobra

Re: 03/08/2018 Live Update

Posted: Thu Mar 08, 2018 4:49 pm

by Cobra

well, guess that's it for today. Non farm payroll day tomorrow has been generally bull friendly. thank you guys, I'll see you tomorrow.

before the close, please take a little time to vote for me, thanks.

https://stockcharts.com/public/1684859/tenpp