DISCLAIMER:

The trading log below is meant for myself only which main purpose is to help improving my market sense.

- My blah blah about how the market would go in the next dozens of minutes everyday in this forum, is a way to force me to focus on the market, because by speaking loud, if the prediction is wrong, I'd be embarrassed, which of course I'd like to avoid as much as possible.

- Day trading is not my strongest point. Just for the same pattern, it can repeat frequently on the 5 min chart while on daily chart it may take months to appear once and another month to know whether the idea of trading such a pattern is right or wrong THIS time, so practicing on the 5 min chart is a fastest way to learn to trade.

- Day trading inevitably would have good days and bad days, it's a part of the game. If I always have good days, it means I'm either lying or already the richest person in the world (then why I'm still trading?), so please don't blame me for making any bad calls. The log is for myself only, not meant to be followed.

SUMMARY:

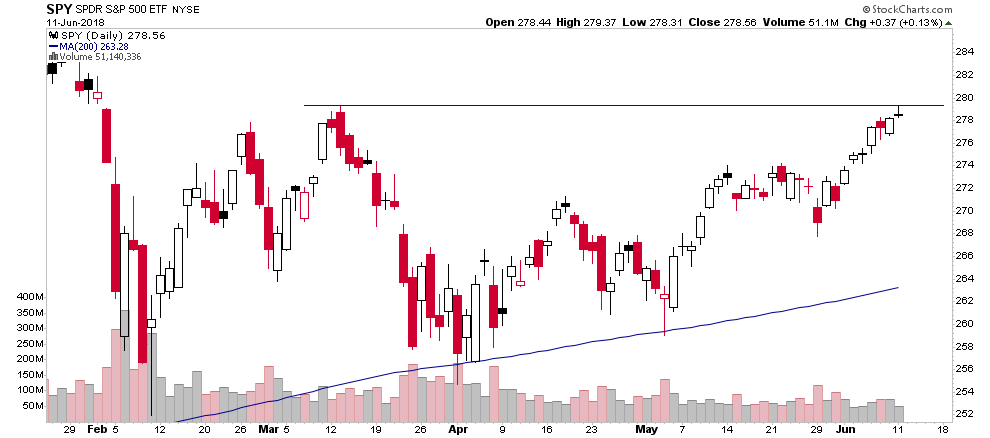

Trying the idea of H1 today, both failed. Didn't realize SPY was testing the Mar 13 high. I always pay attention to the previous few days high or low but often forget to check important daily highs or lows more than 2 months away.

- 1.png (11.36 KiB) Viewed 797 times

NOTE:

By here (

viewtopic.php?f=2&t=2919&p=255538#p255538), I knew the breakout was for real, the trend is up for the day. Generally could be a buy first ask later here. I hesitated because I couldn't believe bulls wanted to push up again today, so I decided to see another bar.

Trying H1 long here (

viewtopic.php?f=2&t=2919&p=255543#p255543). I tried the idea in the past, it didn't work well for me, mainly because of the stop loss. If it's too close, it can be easily stopped out and later have to try again, you'll see example in the next few lines. If it's below the start point where the push up starts, it often fails to reach 1x mini target. The original idea by Al Brooks was 1 point target then move stop loss, I tried, it took just 1 loser to eat up a few past winners' gains and it seems he now uses the push up start point as stop loss which as I mentioned would make 1x target unlikely. He also mentioned to move stop loss when you have gains so that 1x target can be reached which make 50% sense but still doesn't solve the problem of "risk reward ratio is less than 1" because when you entered the trade your position size was calculated based on the original stop loss so when you later move stop loss, even you hit target, your position size is too small therefore you actually make less than 1x, while when it's a failed trade, often you don't have chances to move stop loss so the loss almost always is the max risk you allowed for each trade which is 1x, so the risk reward still is less than 1.

By here (

viewtopic.php?f=2&t=2919&p=255544#p255544), if the stop loss was below the signal bar low (5 bars earlier), it should be stopped out without hitting the 1x target first.

Here (

viewtopic.php?f=2&t=2919&p=255545#p255545) was what I mean for H1 long if the close was too close, it's easily stopped out and later had to go back in with even worse entry.

Failed H1 long again (

viewtopic.php?f=2&t=2919&p=255550#p255550), at which point I realized it's testing the Mar 13 high and got rejected.

Looked like a good double bottom here (

viewtopic.php?f=2&t=2919&p=255553#p255553). But unfortunately it failed.