KeiZai wrote:

...I am using rather NZD/JPY -also being used by the big hedge funds but this pair is less on the ´retail´ eyes, I am looking mainly for divergence between these two pairs, if AUD/JPY made new high/low but NZD/JPY not confirmed it - then it is problem...I am using also AUD/USD and NZD/USD and so far this strategy have very high winning rate - very close to 100%

I can make charts next weekend where you will see how it works

.

I would love to see these charts. I use a collection of moving averages and their RSI, CCI, BB Squeeze etc. to spot the trend.

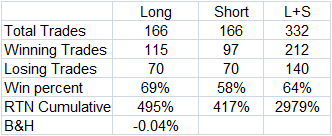

In my hands 1hr generates best signals. Here are the STATs of AUDJPY back testing to March 2007 and buying or selling SPY.

- AUDJPY.png (3.32 KiB) Viewed 3549 times

Combining signals using other currency pairs listed on my momentum block and acting when they all and SPY agree further improves the performance of this strategy.

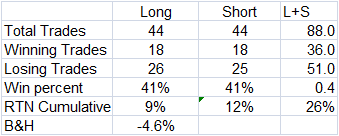

Dr. AL, I wonder if this setup may serve your purpose as this can be used in lower time frames. Here is, for example, performance of a trading setup for IWM using trend in RVX (using 5 min data) since 2/8/2012. I can share the detailes of this strategy if you like

, just PM me.

- IWM by RVX.png (3.05 KiB) Viewed 3549 times

Above is provided for informational purposes only and shouldn't be considered an investment advice or recommendation to buy or sell anything.

I can make charts next weekend where you will see how it works