Black Gold-

Continuation of existing trends. That means US production up, imports running at last years level less about 800,000 barrels a week of exports and refinery run rates dropping. OPEC stated goal was to return world storage to the 5year average by July. So they have 18 weeks or so, say 20 because it is easier to do in your head, to get the US surplus of 164 million barrels gone. The longer it takes to start then we will have to see a 'panic the markets everybody buy long drop' going into summer OR admit OPEC didn't do what they said.

Well Cats, how much oil do we use in a week? Top of my head horse shoe and hand grenade accuracy 18 million barrels, roughly half from domestic production and about half is imported from Canada and elsewhere (tankers).

From the EIA Crude oil imported from OPEC in thousands of barrels per day by month.

https://www.eia.gov/dnav/pet/pet_move_i ... blpd_m.htm

Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16

History

U.S.

3,502 3,118 3,314 3,110 3,242 3,295

So to make goal they really need to cut exports to the US by about a third and hope we don't find other sources. But the reality is Saudi just cut prices to Asia as they continue to battle for market share with Iran back to 1997 production levels and others (think Nigeria and Angola) recovering from drastic reductions.

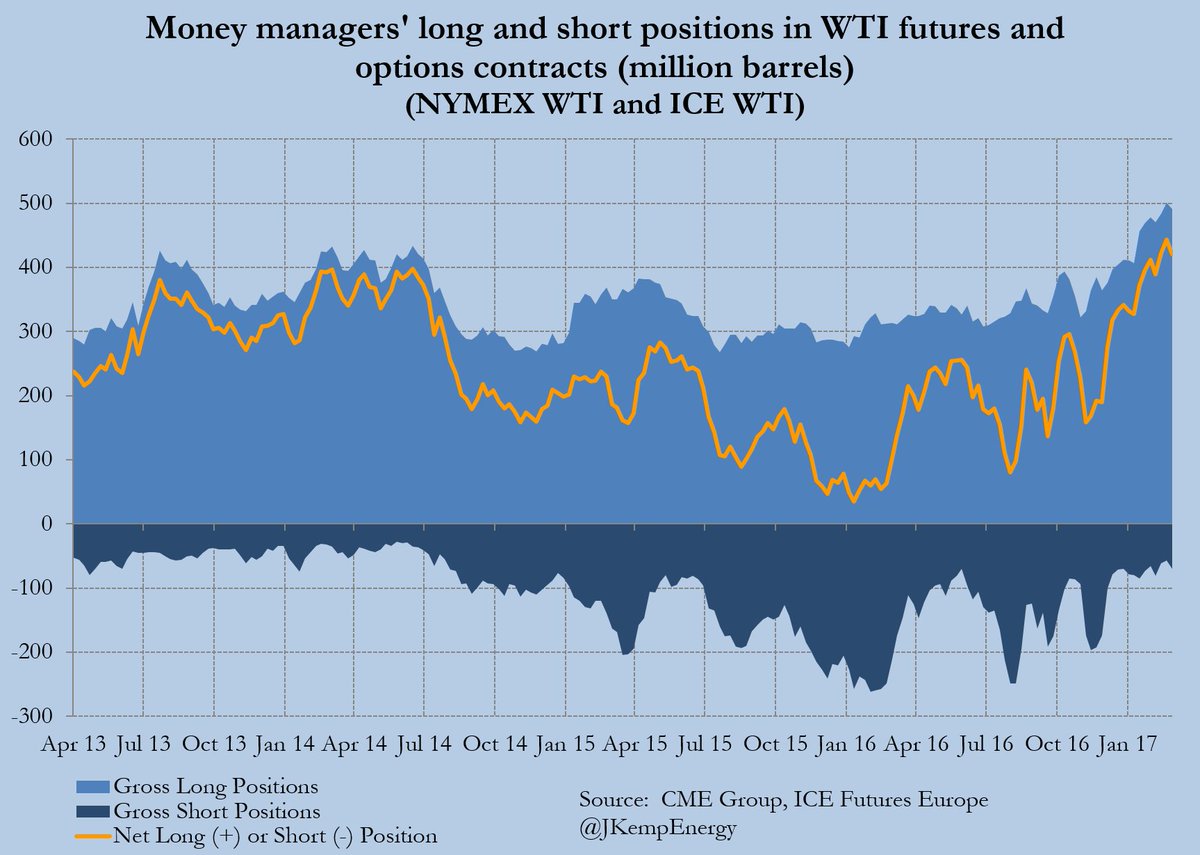

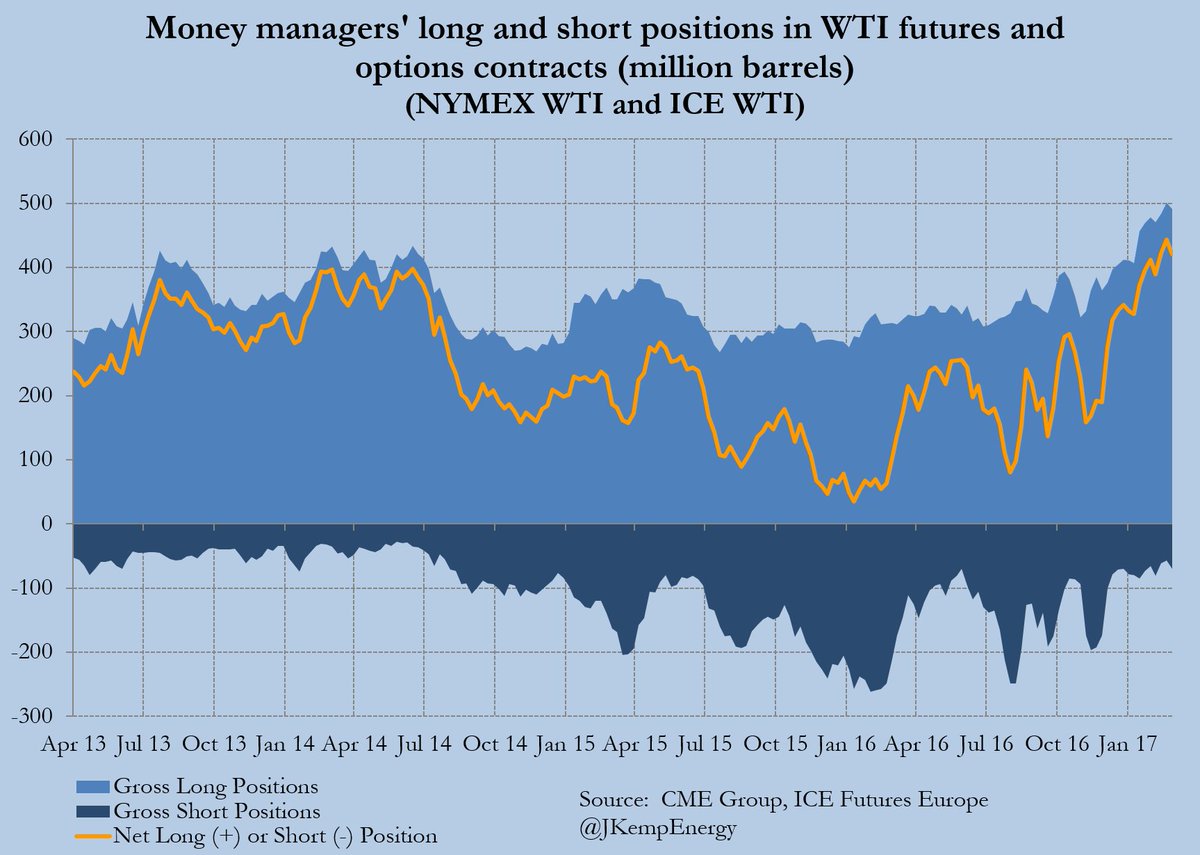

Well what about the hedge funds? Slight reduction in long positions. From John Kemp at Reuters

Several on this forum post great charts of CL. Collbizone out there on twitter, the Elliot wave trader I follow has gone short crude and put up his wave count, which is a different perspective. As Mr. Bachnut said he will (Coolbizone) will abandon a position very very quickly if he does not like the price action, then go right back in an hour a day or week later.

His public comment March 2 was " $WTIC is heading much lower towards $42-$39, needs to break $50.71 in coming weeks at $52.65 now" Then at 12:00 on March 3 "added more at 53.32, Av. ahort entry now at $53.06. Stop at $53.70 x 12 (will lower the stop as market allows)". So he is in for 12 contracts for now. You do the math on exposure!

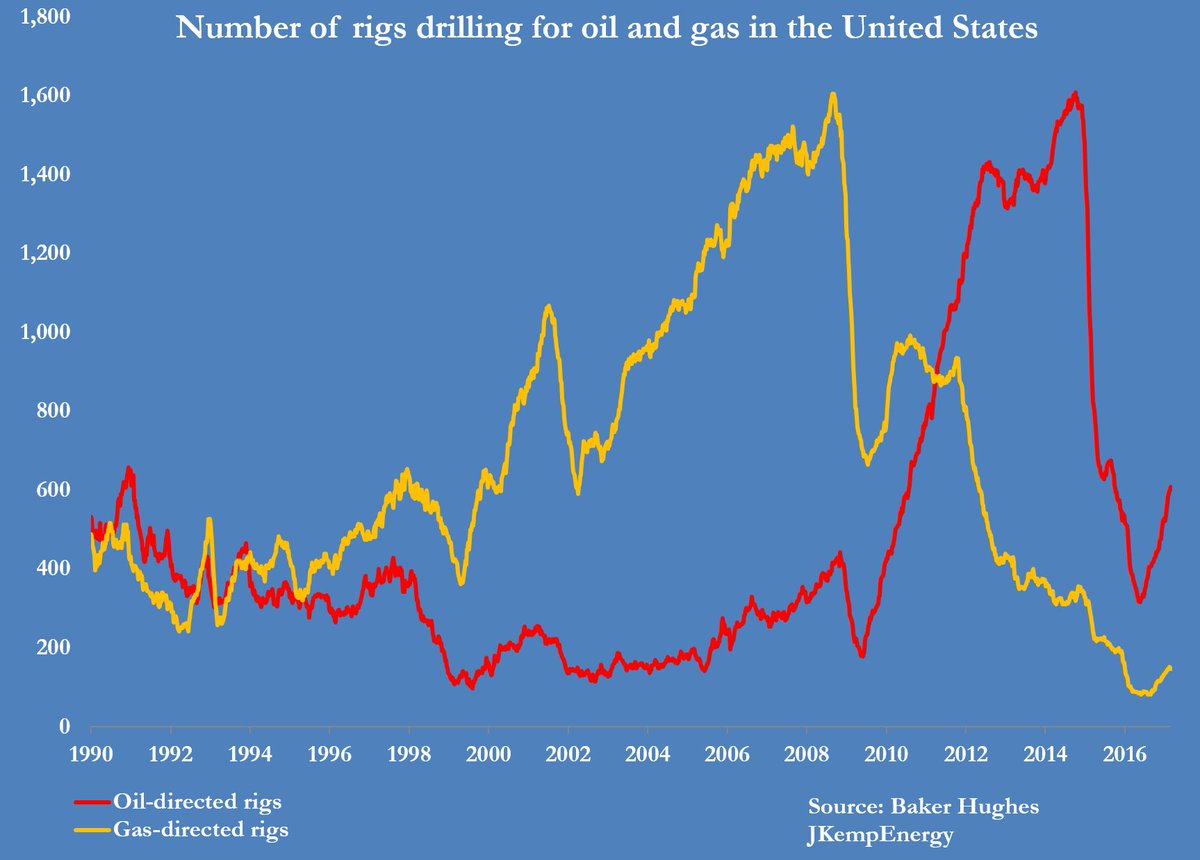

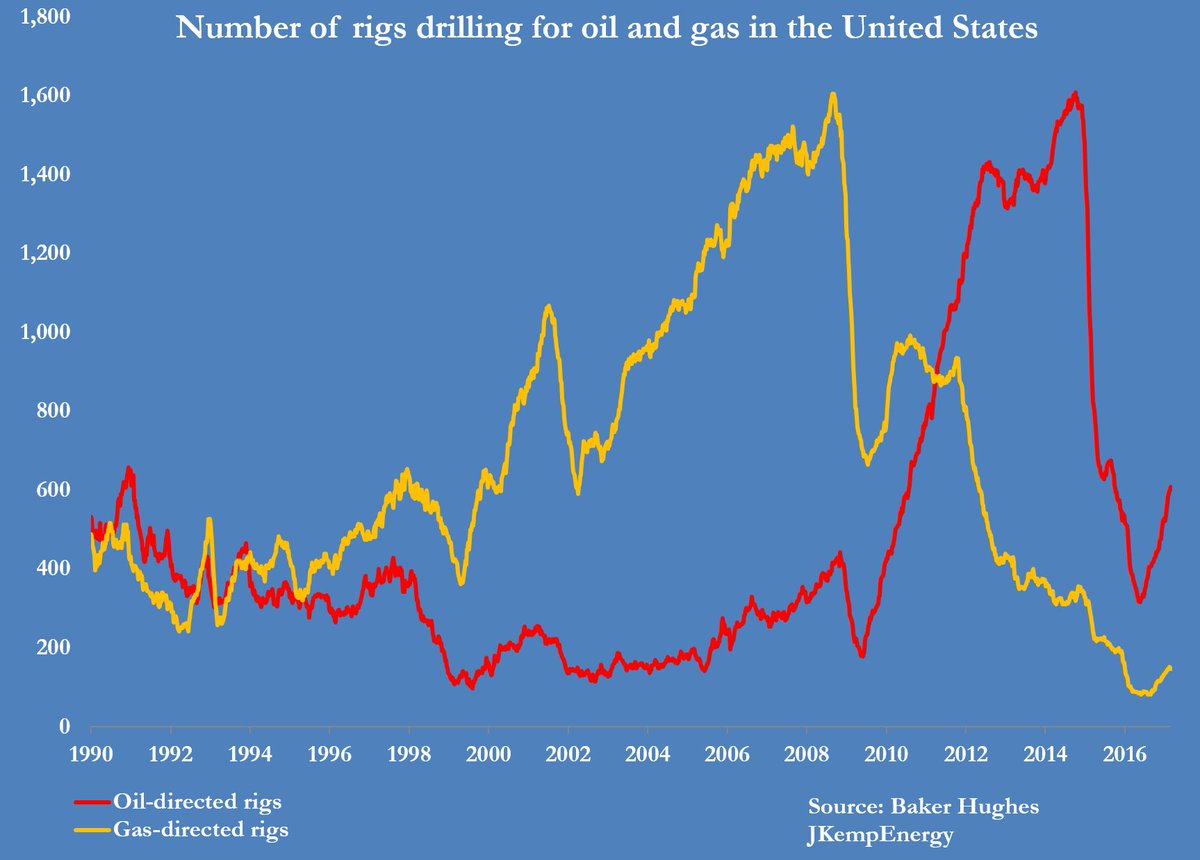

To close here is a look at drill rigs from John Kemp. Makes it pretty clear hoiw Wall Street's 6 plus billion of new equity money into the shale drillers was spent