Re: 11/04/2011 Intraday Watering

Posted: Fri Nov 04, 2011 12:42 pm

What day are you getting 1243 from?ramram wrote:To clarify more -- ES is the SP500 futures. I use the daily pivot.

The Intraday US Stock Market Discussion Board

http://bbs.cobrasmarketview.com/

What day are you getting 1243 from?ramram wrote:To clarify more -- ES is the SP500 futures. I use the daily pivot.

Lol... Everyone full bulltard! Especially because the 125.5 area is starting to look like a brick ceiling and NFP was terrible!BullBear52x wrote:Yeah, take one for the team! this is so funnystucap wrote:please coverqtipped wrote:124.85 is my mental stop...it has to be taken out...didn't execute yet...just drifting....but i'm sure after i cover it will fall hard.take one for the team!

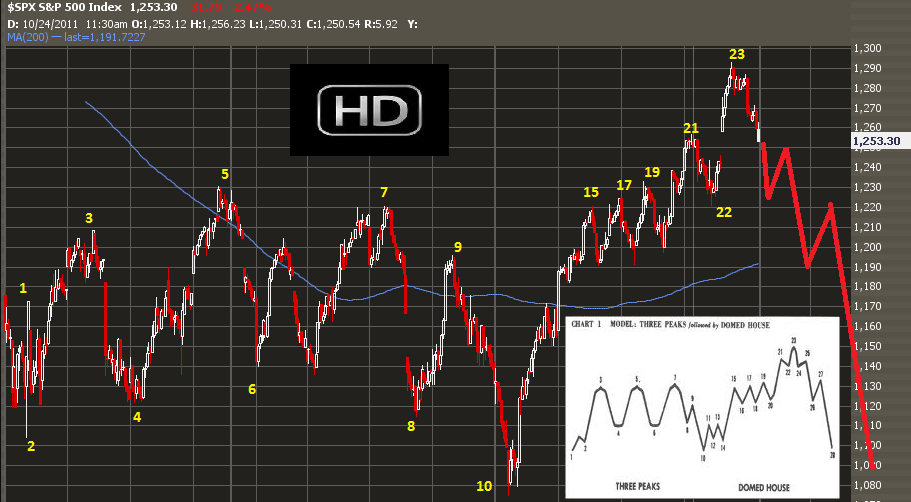

ray-bans is good, basic and traditionaluempel wrote:Ahh, I like 13. By the way, what kind of shades are you wearing, as far as I see they are ray-bansDow Trader wrote:another view in the daily chart

I see today -- 1243 pivot -- 5 minute ES charttrader0303 wrote:What day are you getting 1243 from?ramram wrote:To clarify more -- ES is the SP500 futures. I use the daily pivot.

you still didn't pay attention to the little curves above the MA I put on my 5 min chart, that's 1% away from the EMA20 which according to your Earth gravity is too much for an traday . That's the answer. The reason I don't answer you directly is I just want you to find it so can remember it.Dutchy wrote:Sorry, this is a little thread from yesterday's watering..xfradnex wrote:Note that MA setting on this 1 minute chart. When the actual price from the Red line is double the distance between the Red and Blue, this would be a good opertunity to short. The more stretched the lines are apart the better the final outcome. Need to compare all the upward humps. I marked the best one, the opening. These are rules of thumb. Need to develop the eye to see these geometries. note the distances between the lines for most of the previous day as a measure for future price/MA movements and opertunities. .Dutchy wrote:Thanks for explaining xfradnex. But wouldn't that imply that every opening is stretched by this criterium? The price action is always ahead of the MAs after all. Or is there a quantitative criterium for the separation?xfradnex wrote:Look at MAs on his chart. if there a very large seperation between MAs and actual the lines, they will try to meet each other in the middle somewhere. From there, who knows. Most of the time this will happen on the open(when there has been a gap up or down) or when there has been big market news. In this mornings open, there was a gap; a good opertunity for a move for 15 minutes or more. Need to figure out what the S&P implied open is and translate that to a SPY, SSO, etc. be ready to pull trigger on very open.(GLTA). I need to do this myself(find a good place that gives a good implied opening value on the Web).Dutchy wrote:Hi Cobra, this morning you called the opening stretched and voiced the expectation of a pullback which happened as predicted.

What is your definition of stretched? Is it the absolute size of the gap or in relation to a previous pattern?

Thank you,

Dutchy

Thanks again xfradnex and Cobra for replying. I studied opening again but am no wiser. While it is true that at opening the gap between MA and price was largest for day, this would be true of every big gap. But not all big gaps are followed by a pullback. So I am maybe very thick but I still don't see how yesterday's opening was especially stretched or how a pullback could be implied in this case compared to any other gap up..

I don't think it will make it to $100. A wise man on CNBC said it was worth $8.Me XMan wrote:I'm gonna short this sucker when it gets to $100.

proteus46 wrote: A GroupOn chart, be careful

Last month was difficult to trade for a trend follower.fibo618 wrote:Cobra,

Just curious how you rate the last couple of months in terms of diffculty of forecasts? Was 2010 better... I was seeing EW forums saying something similar...

thx

bears = prayqtipped wrote:can someone tell me what kind of pattern we're in intraday...confused..