Page 3 of 5

DON'T LISTEN TO ME

Posted: Sat Jan 16, 2016 11:00 pm

by MrMiyagi

- disregard this chart combo pack

Re: 01/16/2016 Weekend Update

Posted: Sat Jan 16, 2016 11:58 pm

by DellGriffith

My thinking is a rebound to 204 in 10 trading days.

1. I've got a buy signal and went long.

2. SPY 204 would fill the gaps on the chart.

3. SPY 204 might hit the upper bb.

After that, sure retest the bottom. That's constructive. But man, the other option doesn't make sense to me.

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 2:36 am

by BullBear52x

Big layoffs on the line, prepared for soft landing.

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 10:45 am

by rhight

DellGriffith wrote:rhight wrote:(swing to intermediate trade) I just went long on Friday at 1876 (SSO) with an aggressive entry after my system generated a Buy on Thursday, and then again on Friday.

20% long, 0.5% at risk.

Thanks for posting! I admit I cannot see what gives you your buy signals (altho I see the buy signals as blue arrows) based upon the chart that you posted. However, you said it gave you a buy signal on BOTH thursday and friday, which is interesting because my own system I used to go long at the close on thursday also gave me big buy signals on thursday and friday.

edit: actually, when I compare the two, almost all of your blue arrow buy signals correspond to all of the buy signals my system generated (the system I used to make the buy). There are a few places of disagreement but its almost exact.

Best of luck!

Dell, you're right, I only indicated my buy points, although on that scale it is difficult to tell the exact day, I lined the arrows up with a verticle line that was then deleted. It is my own development, and looks at 6 technical factors that comprise a truth table, when they are all True it gives a Buy, and I update the spreadsheet at EOD. There are an additional 3 factors that are not deal breakers, but are supportive on the day of trade and it is good to see them True also. All 9 factors were true on Thursday, and 8 were True on Friday. If I see that it is going to be True near the EOD I give myself permission to execute on the day the signal is being generated. Why? Because quite often the next day is a gap up! Fortunately, I was lazy on Thursday and didn't buy! It is obviously not a trend following system. I have 3 mechanical entries. The first was triggered Friday, I have two more that haven't set up yet. Why do I have 3? To scale in and as backup in case I miss the first one or two set-ups. Why so complicated? Because I kept missing bottoms and wasn't clear on how to join a new trend once it started, although now with more experience I have a better idea. I'm a natural bear, and so I had to really give myself some really clear criteria on when to go long, and highly defined set-ups. Risk is defined so I won't lose my shirt (as I've been know to do

) I also do Time and Price cycle analysis using my own spreadsheet developed from the work of Miner and Boroden to support the other decision matrix.

As far as capitulation goes, true, the TRIN did not exceed a threshold often used (2.65) to indicate capitulation, but there have been three 9:1 NYDNV:NYUPV days during this downtrend, two in the last three days, and that counts as capitualtion in my system. Looking at the underlying factors in the TRIN formula, you can see that both ratios (NYADV/NYDEC and NYUPV/NYDNV) have been very small, which means that both NYDEC and NYDNV have been very large. I think that means capitulation even though it doesn't calculate out to exceed the given threshold.

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 12:09 pm

by DellGriffith

I do the same thing rhight. I have a ruleset (a mix of indicators and how I read them) to establish buy signals. I got two buy signals back to back the last two days on the intermediate term system I use.

I also have a ruleset for daily SPY MACD bullish crosses for intermediate term buys. It USED to be almost perfect (like 37-1) for year and years. Two of the last 4 have failed (both in 2015).

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 12:10 pm

by DellGriffith

If SPY drops to 1600 and we wind up not hitting the upper bb by March 7th, that basically says people were more positive and euphoric about investing in stocks in 2008 than they are today. I can't get my mind wrapped around that idea, but there it is.

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 12:42 pm

by fehro

SPX 5m.. Tuesday road map..fwiw…- lean up slightly more than down. Seems like the world indexes play games with the ones that are closed, by taking them "offside" so up in Asia, Europe?, US gap up Tuesday?.

Gap up 5-20 points, green arrow. Gap down -10 points Red then reverse up sharply. Or just bleed deeper. Lean towards a gap up, fwiw. Will know in a few hours with the futures.

Capitulation with Oil tomorrow? 26.50/25.50 - Iran deal done.

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 12:48 pm

by josephli

fehro wrote:SPX 5m.. Tuesday road map..fwiw…- lean up slightly more than down. Seems like the world indexes play games with the ones that are closed, by taking them "offside" so up in Asia, Europe?, US gap up Tuesday?.

Gap up 5-20 points, green arrow. Gap down -10 points Red then reverse up sharply. Or just bleed deeper. Lean towards a gap up, fwiw. Will know in a few hours with the futures.

Capitulation with Oil tomorrow? 26.50/25.50 - Iran deal done.

yep, interesting that so many important things happening while us market is closed. but the iran re-entry into oil market has been known for a while, so there is no actual surprise. market reaction is hard to gauge.

in another news, PBOC increase reserve for offshore yuan account.

http://www.bloomberg.com/news/articles/ ... n-accounts

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 2:37 pm

by gappy

If Uncle Buck stays bed ridden, the market hurts. If he gets up on his crutches, the economy suffers. Got him right in the gut.

Capture.PNG

Failure to get to know thy enemy it seems, at least at first glance.

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 3:19 pm

by DellGriffith

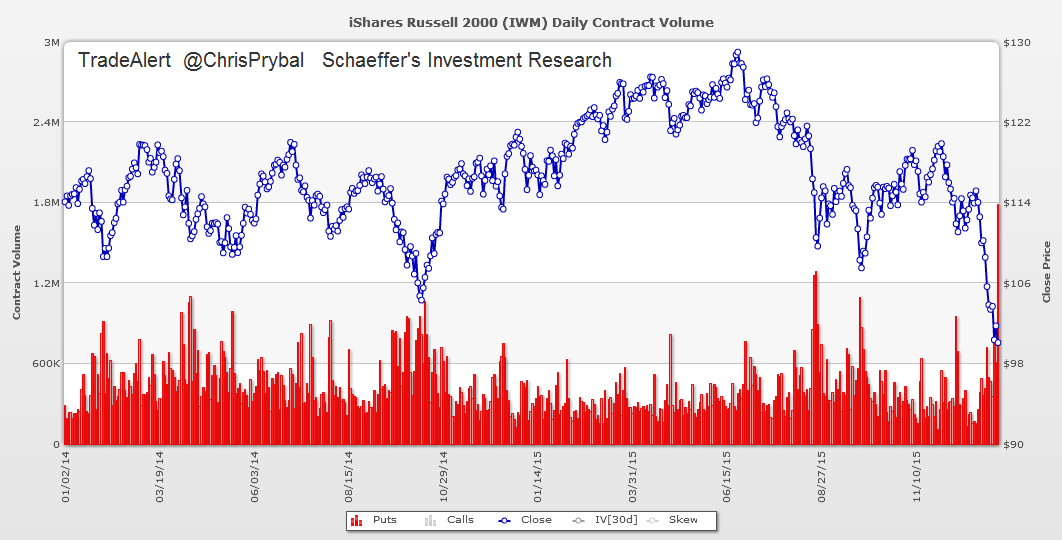

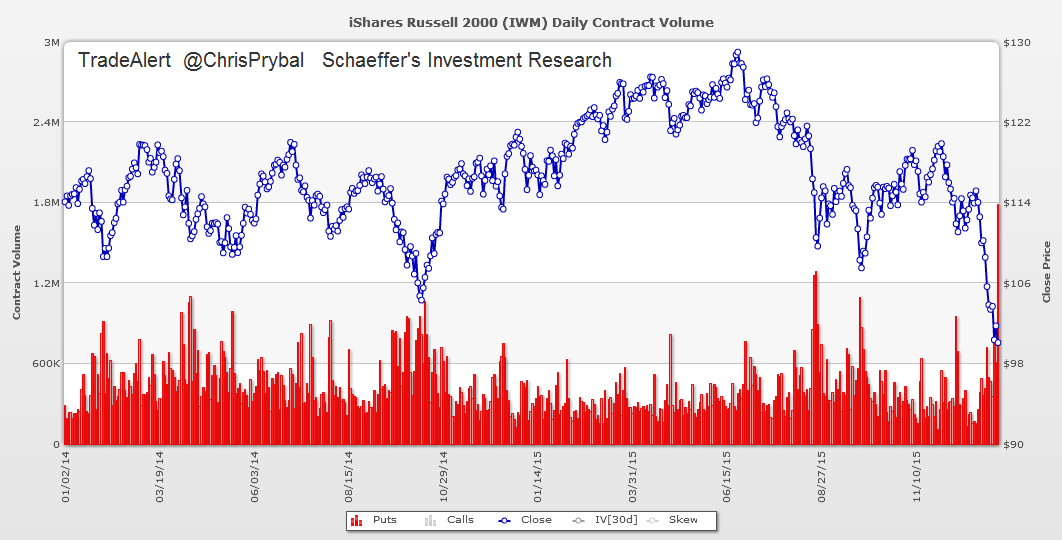

Record IWM put volume on friday.

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 3:44 pm

by jademann

Oil could be buy the news, but as you say who knows

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 4:43 pm

by icman

Guys, how do you manage not to think too much about the markets during the weekends? These long weekends are always excruciating.

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 5:27 pm

by DellGriffith

icman wrote:Guys, how do you manage not to think too much about the markets during the weekends? These long weekends are always excruciating.

This is a really big weekend. I think last week was one of the most interesting weeks in investing I've ever seen. Hard not to talk about it.

Posted: Sun Jan 17, 2016 5:33 pm

by MrMiyagi

icman wrote:Guys, how do you manage not to think too much about the markets during the weekends? These long weekends are always excruciating.

I used to, nowadays I just switch off that thinking and barely post on weekends.

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 6:47 pm

by uempel

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 9:20 pm

by taggard

Guys how do you manage not to think too much about the markets on the weekends? These long weekends are always excruciating.

Actually important point to consider. Typically younger guys or beginners equate more work thinking effort or more knowledge with success not only in trading but in other areas like sports scholarly stuff and so on. this often leads to burn out. This is one of those time to listen to the older guys who hit the wall over and over until they wised up. short term over exerting gets you the adrenal response (goog it for details). Longer term you find yourself tending to focus on things the same way as opposed to letting in new information. Everything that grows plants people ideas and so on go through a series of on off sequences. For a child there will be growth spurts and then plateaus. This is not only natural—the absence of this plateau period prohibits both rest and integration of the prior growth spurt.

If you are new to trading—or younger in general—do not fail to appreciate the idea of “a recovery period”. amusingly nobody ever listens to this advice while they are young or often at the beginning of an enterprise (even if they know better). Burn out--mental or adrenal or even philosophical/epistemological will sneak up when you are not looking and make you far less effective at the exact time you need it. life is short find ways to enjoy your off time and look for patterns in other places you can use. Living near the beach is a constant reminder of the in/out pattern of the waves and watching birds there nailing crabs is pretty much like watching 5 min chart traders trading the eminis. So you can learn to wire patterns using other senses or using visual clues in different forms.

Despite the tendency for technical traders to rely on chart based data—a trader is a human being who happens to use technical data. Trading is 90% you and 10% your data. If you are not sure of this just watch various people trade the same ideas. it's not the ideas--it's your use of them that is the issue.

Bottom line time spent away from the market can actually benefit you vastly more than extra time in the market. Look to conserve energy. Look to learn stuff by analogy metaphor and simile and thus improve your trading skills while actually taking time off. An ok book on this last stuff is “sparks of genius” esp the idea of “play”. Not in the book but useful is “inverting” just consider the exact inverse of your basic take. We are all creatures of habit—one way or another—time off is way to confront that directly or indirectly.

Good luck with your trading

Signed enjoying the weekend

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 9:59 pm

by DellGriffith

taggard wrote:Guys how do you manage not to think too much about the markets on the weekends? These long weekends are always excruciating.

Actually important point to consider. Typically younger guys or beginners equate more work thinking effort or more knowledge with success not only in trading but in other areas like sports scholarly stuff and so on. this often leads to burn out.

I disagree. For example, in the NFL, I name a long list of highly successful NFL head coaches that were "gym rats". They lived and breathed it. Bill Belichick puts in insane hours without tiring for decades. Marty Schottenheimer did the same. I remember reading stories about how Joe Gibbs would sleep on a cot in his office so he was more efficient at waking up and breaking down more game film.

But the key word I think you used was "work". If this is work to you, you might burn out. But if its a true hobby, if its fun and exciting, then you won't burn out.

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 10:03 pm

by DellGriffith

You know, I cannot think of a single successful NFL head coach that said "well the key to my success was getting away from it all as much as possible to relieve stress and not burn out". You should love what you're doing at that level. It shouldn't even BE stress to begin with or you're in the wrong job.

Re: 01/16/2016 Weekend Update

Posted: Sun Jan 17, 2016 10:46 pm

by DellGriffith

Re: 01/16/2016 Weekend Update

Posted: Mon Jan 18, 2016 12:52 am

by DellGriffith

Crazy rumor I'm hearing tonite is the price of gas has dropped to 49 cents in the state of Michigan in some places.

gas buddy has it at $1.38 in Michigan.

http://www.michigangasprices.com/