Page 1 of 2

07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 4:43 pm

by Cobra

Institutional buying and selling chart from stocktiming shows more distribution than accumulation, so the trend resumes down again.

Re: 07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 4:46 pm

by Cobra

Smart money huge short, so it's case 1 below, not good for bulls.

Since there're some arguments about how to read the chart, so it's necessary for me to explain here how I use this chart:

I don't care what's the logic behind the chart. I found it works in the following two cases:

1.) When market up huge, if I see smart money huge short, best if new record short, then I know a short-term pullback is due soon.

2.) When market down, if I see smart money suddenly rises from very negative value, then I know the pullback was over.

So I only use this chart for the above 2 cases. Besides those 2 cases, it means nothing to me. i.e. the absolute value of this chart means nothing to me, I only care if it rises sharply or drops sharply.

Re: 07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 4:47 pm

by Cobra

Posted: Fri Jul 24, 2015 4:48 pm

by MrMiyagi

SPY: 174 targets 138 hits within 10 days, 79.31% rate. 7 open targets left, all to the upside.

sorry, i had the wrong image file.

Re: 07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 6:14 pm

by fehro

INDEX Weekly/Daily Candles

Re: 07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 6:20 pm

by fehro

Industry % Weeklies. Volume increasing with the down move in SPY fwiw.

Re: 07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 6:22 pm

by fehro

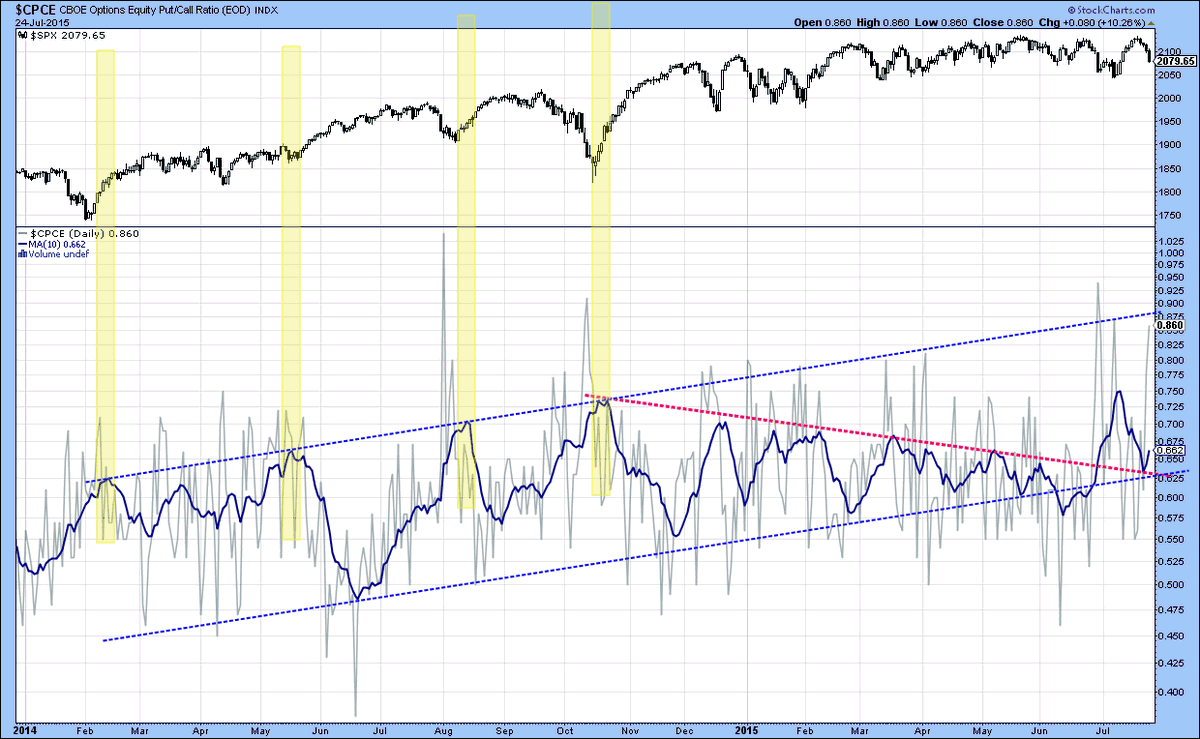

T2 http://www.worden.com/TeleChartHelp/Con ... rs_T2s.htm Put/Call very elevated again. Last weeks weakness in indicators, confirmed this week.

Re: 07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 6:25 pm

by fehro

Yields

Re: 07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 6:30 pm

by fehro

T2 Channels % Stocks 1+2 Channels <200d Weekly <40d Daily

Re: 07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 6:39 pm

by Cobra

Re: 07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 8:25 pm

by daytradingES

last weekend I posted we would get a doji and roll-over - which has happened and we are half-way down the slide.

This video is on a longer-term view.

http://screencast.com/t/K5BunTWUG

Re: 07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 9:38 pm

by tsf

.

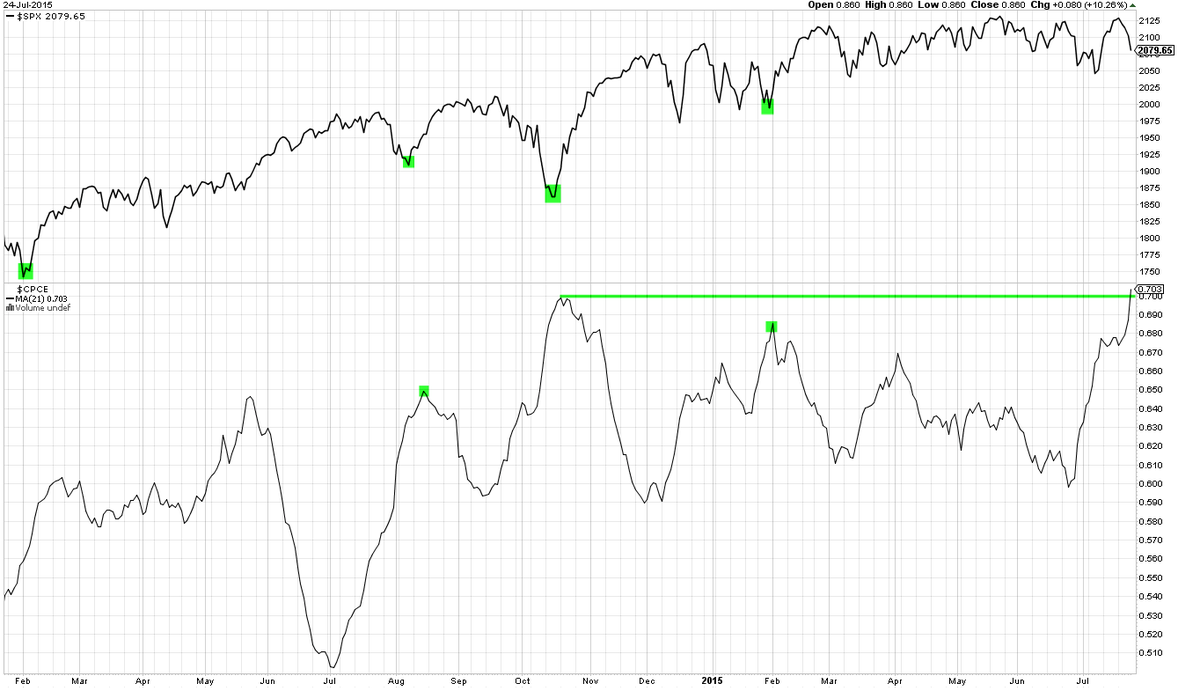

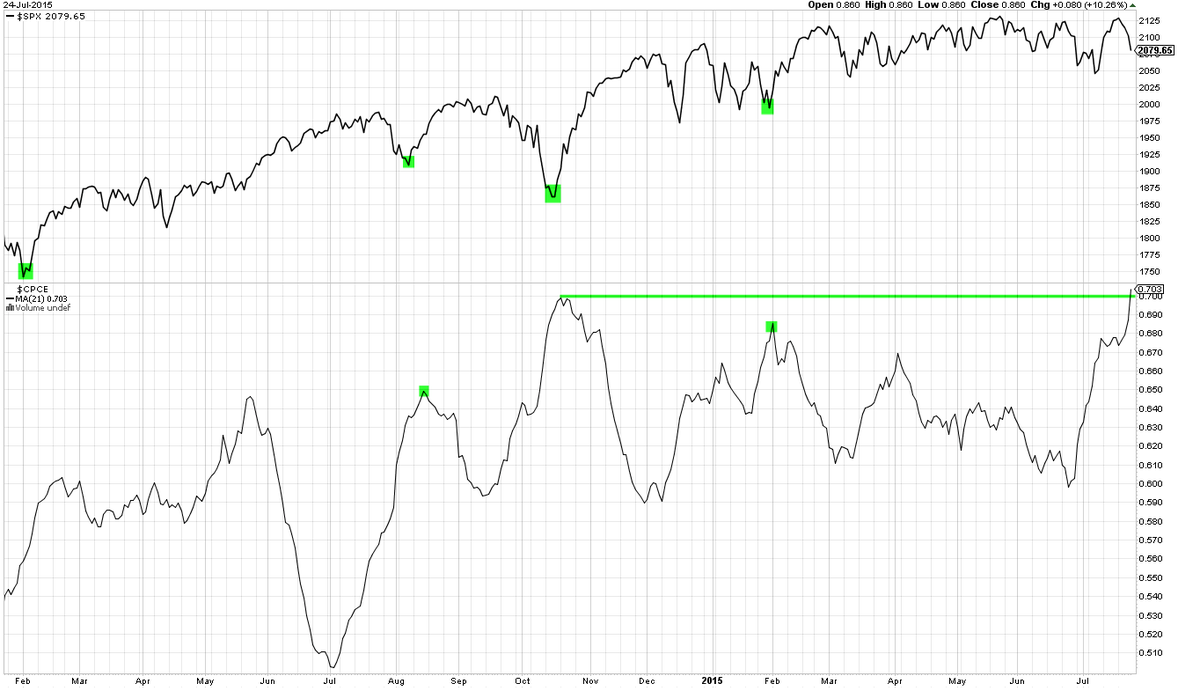

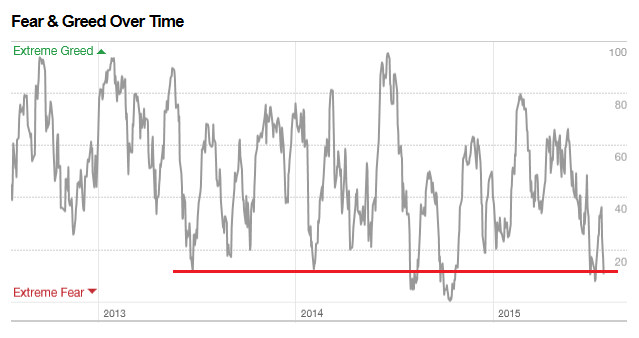

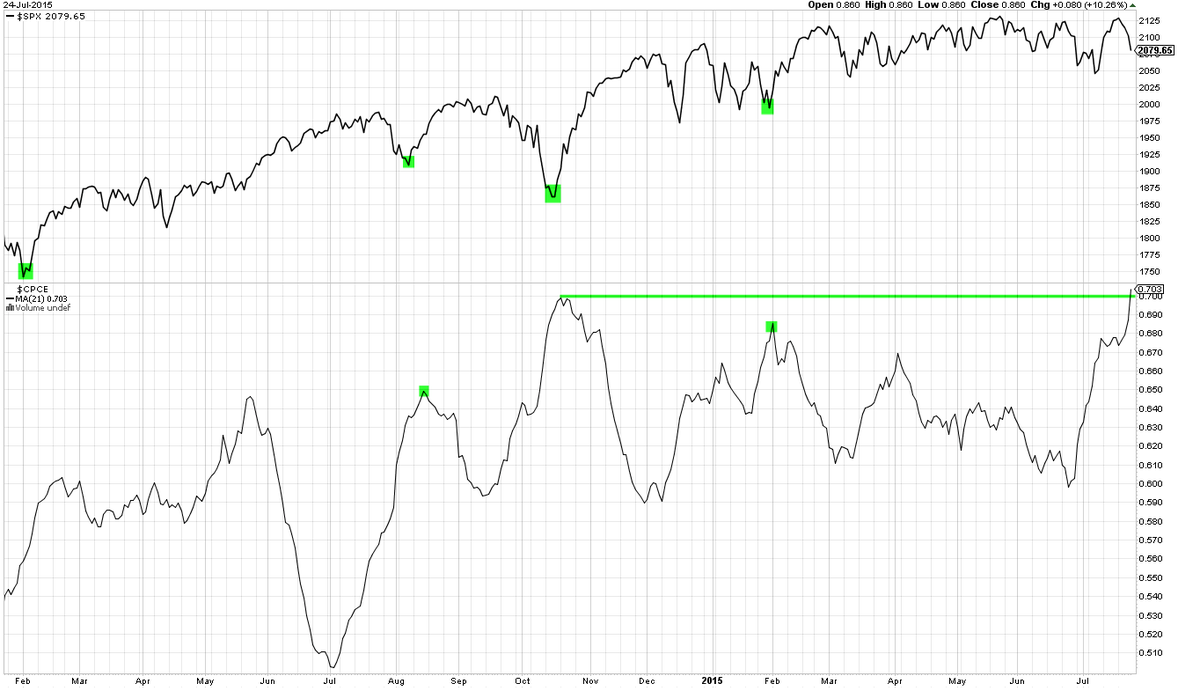

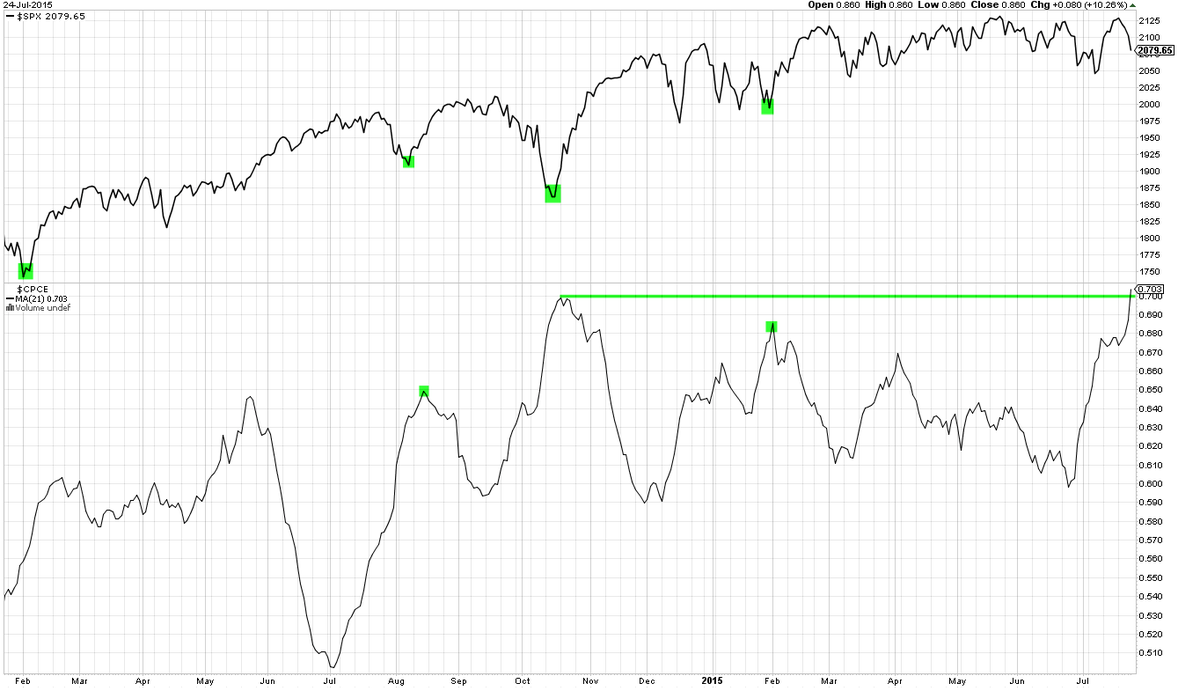

Source: Urban Carmel @ukarlewitz July 24, 2015 1 hour ago

21-d CPCE. This is 2 1/2 year high.

Re: 07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 9:44 pm

by tsf

.

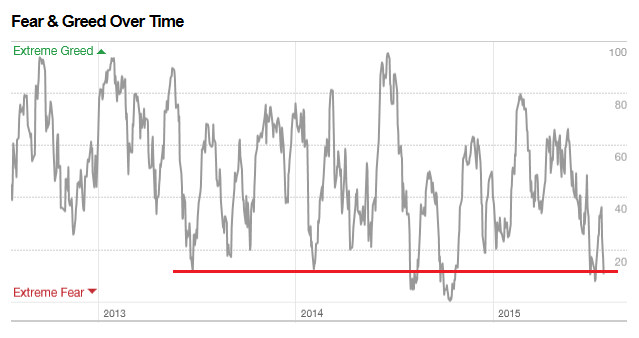

Source: Cam Hui, CFA @HumbleStudent 10:55 AM - 24 Jul 2015

Fear & Greed

Re: 07/25/2015 Weekend Update

Posted: Fri Jul 24, 2015 10:22 pm

by tsf

.

The bear case

Source: StockTwits

Source: ? not sure

Re: 07/25/2015 Weekend Update

Posted: Sat Jul 25, 2015 6:33 am

by marcueus

Yeah

Very very nice weekly candle guys, do not get to greedy with shorts as squeez time is coming

Very serious squeez time for bears is coming

Re: 07/25/2015 Weekend Update

Posted: Sat Jul 25, 2015 12:35 pm

by fehro

SPX the bears are have a very pretty set-up.. "IF" there is follow through.

Bottom Monthly candle next week will be of keen interest.

Middle chart.. bears see a re-test of a broken trend from 2009 lows, bulls see a mid channel support.

Top chart.. highly speculative, but stacked H&S... on shorter time frames... it's a favorite of mine, if you been reading this board for awhile.

All depend on price and how it plays out.. of course. But something to keep in mind. fwiw.

Re: 07/25/2015 Weekend Update

Posted: Sat Jul 25, 2015 1:18 pm

by jademann

"Down hard on the 60"

Look at the volume 60ma red line. Some use this as a buy point, wonder if it works?

http://stockcharts.com/h-sc/ui?s=USO&p= ... 7841303351

Went Long SLV and GLD at bottom on Friday. Looking for a short term dead cat bounce.

http://stockcharts.com/h-sc/ui?s=GLD&p= ... 2608052039

USD is key to all imho

http://stockcharts.com/h-sc/ui?s=UDN&p= ... 0816291590

Re: 07/25/2015 Weekend Update

Posted: Sat Jul 25, 2015 4:38 pm

by QED

tsf wrote:.

Source: Urban Carmel @ukarlewitz July 24, 2015 1 hour ago

21-d CPCE. This is 2 1/2 year high.

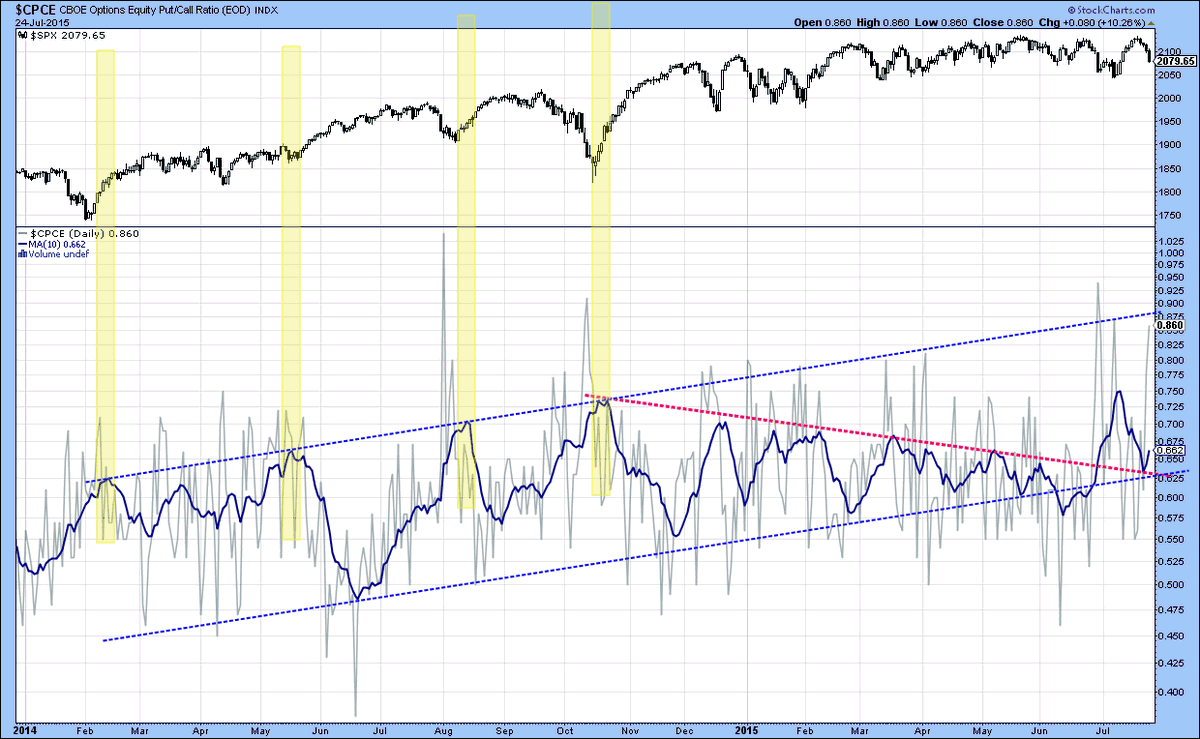

Here's the 10d ma on $CPCE: pic.twitter.com/9eHJJFDILF

Looks like it's heading higher.

The 21d has a similar breakout pattern.

.

Re: 07/25/2015 Weekend Update

Posted: Sat Jul 25, 2015 6:52 pm

by tsf

.

QED, thanks for the updated tweet.

QED wrote:tsf wrote:.

Source: Urban Carmel @ukarlewitz July 24, 2015 1 hour ago

21-d CPCE. This is 2 1/2 year high.

Here's the 10d ma on $CPCE: pic.twitter.com/9eHJJFDILF

Looks like it's heading higher.

The 21d has a similar breakout pattern.

.

Re: 07/25/2015 Weekend Update

Posted: Sat Jul 25, 2015 9:00 pm

by Al_Dente

The last time that the market action was concentrated in the giant mega-cap stocks was back in October

Vote:

https://stockcharts.com/public/1684859