Page 2 of 3

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 12:15 pm

by te_fern

TICK keeps heading lower as price moves sideways. Something has to give...

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 12:16 pm

by te_fern

SPX sideways action...

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 12:49 pm

by Trades with cats

Oil, I have been banging this drum from time to time. Looks like it is getting to be a real problem, as drilling could stop for several months and production would just keep rising. Current DUCs in the Permian (all according to John Kemp) 2,330 with 350 completed last month. An 8 month supply.

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 12:55 pm

by Trades with cats

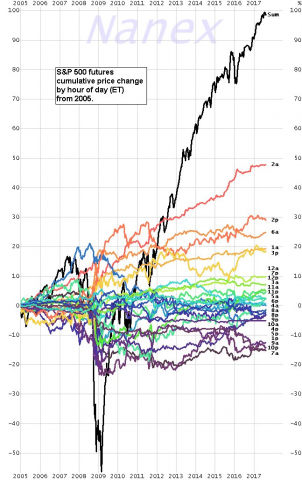

- From Eric Scott Hunsader's Twitter Feed. ES gains by hour of the day.

Makes it clear that I need to re-arrange my trading hours!

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 1:06 pm

by Trades with cats

Small Caps on sell first ask questions later status. Now bouncing on that 20 day ADR low. This normally would be close to the days bottom but after last week I say it the odds favor this being the bottom for today.

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 1:07 pm

by fehro

fehro wrote:brokebybernacke2 wrote:fehro wrote:fehro wrote:/ES 30m H&S looking for SPX 2459 ish target

almost ding ding.. mind yGAPs on indexes.. buckle up

think range day today, we may rise a bit tomorrow into minutes. there's that gap to fill yet 2071 ish, then maybe we get some good downers..art cashin is very cautious..

yup… IWM nLOD… futs 30m candles possible bearish engulfing… need SPY and QQQ LODs to go.. for yGAPs with VIX /VXX nHODs Bonds keep climbing

buckle up IWM nLOD, looking for yLOD on IWM - another H&S /ES 30m 'if" LOD goes.. target is about SPX 2449

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 1:48 pm

by Trades with cats

Small Cap Futs not bouncing up and away, coming back down for a second crack at 1382.3, the 20 day Average Daily Range Low (13.2 points from the open). This is supposed to be boring statistically, as usually we would start a slow painful drift up from here.

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 1:53 pm

by Trades with cats

If you are curious, and these are all Regular Trading Hours, RTH (old open outcry pit hours).

TF todays range so far 14.0

10 day average 14.7

20 day average 13.2

ES todays range 8.5

10 day average 12.5

20 day average 11.5

Considering it takes almost two TF points to equal an ES point in nominal amount of securities, but both are valued at $50 it is no wonder the TF is more exciting to trade.

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 1:59 pm

by fehro

http://www.zerohedge.com/news/2017-08-1 ... e-seen-yet

Were the somewhat spooky parallels to continue, 2020 would usher in a two-decade, 13% CAR stock outperformance over corporate bonds as enjoyed during the 50s and 60s.

Which, as Corrigan concludes, would be something to behold... and is probably the most bullish equity market analog we have seen yet.

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 2:02 pm

by QED

Tuesday, August 15, 2017

U.S. Stock Market: Sunrise … Sunset

See what happens when speculative fever cools down

By Elliott Wave International

The market itself provides its own clues about its future price action. One such clue is found in higher-beta small cap stocks vs. lower-beta blue chips.

Every bull and bear market has a beginning and an end.

That would seem to be an obvious statement, but during an extended financial trend, a “no end in sight” sentiment usually develops. Many market observers perceive the protracted trend as the norm.

A perfect example is the current uptrend in the stock market: It started in March 2009 and is still going strong, with the Dow Industrials posting a string of record highs.

This Aug. 4 CNBC headline conveys the optimistic extreme:

‘The bull market could continue forever’ — strategist outlines conditions

But, we’ll stick with the idea that every financial trend has a sunrise and a sunset, including this one.

Review this chart and commentary from our Aug. 4 Short Term Update:

When speculation fades as investors narrow their focus into big-cap stocks to the detriment of small-cap stocks, it provides the early-warning basis to watch the stock market’s big-cap indexes closely, because the rising trend has entered its sunset phase. The chart shows just how dramatic the divergence has become. The Russell 2000/Russell 1000 stock ratio made a countertrend rally high on December 8, 2016 and has trended lower, as the DJIA has trended higher. On Aug. 3, the ratio essentially matched its low of the year, with the DJIA pushing to another new high today.

With what has just been discussed in mind, you might be wondering how other bull markets have ended.

Our August Elliott Wave Financial Forecast provides perspective on the two most recent ones:

Many major stock market peaks are battles of attrition … . In 2007, for example, the Small-Cap indexes, Mid-Cap indexes, the Dow Jones Composite Index and the Value Line Indexes all made highs in June-July 2007 and failed to join the Dow Jones Industrial Average, S&P 500 and NASDAQ at new highs in October 2007. In the wake of that non-confirmation, all stock indexes declined in a major bear market … . On rare occasions, a big bull market will end in conjunction with peak optimism. The NASDAQ’s top in 2000 ended after it closed higher 19 out of 21 weeks during its final push to the March 2000 peak.

At this juncture, we don’t know if the end of the current bull market will more closely resemble that of 2007 or 2000.

But, we do have reason to suspect that 2017 will turn out to be a pivotal year.

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 2:09 pm

by superxy

te_fern wrote:TICK keeps heading lower as price moves sideways. Something has to give...

How to get this $tick ? Can't find it in charts.

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 2:11 pm

by Al_Dente

Relative Strength, aka: who is stronger than spy, or who is cooperating with this “bounce”

Tech and financials (the heaviest weighted sectors in SPY) are above their MAs

SPY could use a bit more help please

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 2:30 pm

by Cobra

now breakout is more likely.

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 2:31 pm

by Trades with cats

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 2:45 pm

by Trades with cats

Knock three times small caps. At least the ES has pried itself off the floor. Are we setting up for an ugly close?

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 2:58 pm

by Trades with cats

Dicks Sporting Goods Conference call-

Summer of 2007 Mrs Cats and I drove the 2,000 miles to Chicago area on I-80. I saw an incredible number of new expensive Harley Davidson dealerships along the interstate and thought "This is going to blow up when the liar loans for home equity disappear". I never followed through. Did the same drive three years ago and saw Cabella's and Bass Pro Shops along the interstate, real palaces. Credit card and car loan delinquencies are up and today's conference call said hunting and fishing channel is really overstuffed.

Are those two like Apple, a scared object of investor and brand faith or will they drop like a rock on bad holiday sales?

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 2:59 pm

by QED

I must be bored …

I have now recreated the Elliott Wave International chart from above in StockCharts.

If anyone wants it …

Link:

http://bit.ly/2x1R8ir

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 3:01 pm

by Al_Dente

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 3:03 pm

by QED

superxy wrote:te_fern wrote:TICK keeps heading lower as price moves sideways. Something has to give...

How to get this $tick ? Can't find it in charts.

In Stockcharts.com = $TICK ... [drop down menu choose = "Cumulative" (Replaces "TYPE" = "Candlesticks)].

Re: 08/15/2017 Live Update

Posted: Tue Aug 15, 2017 3:08 pm

by Trades with cats

Small Caps- This third bounce off the low is looking really anemic while the ES tests yesterday's high.