ROUNDUP from Friday, except where another date is noted:

[Spot Gamma:] The key takeaway from this past holiday shortened week was:

put demand cratered ...despite that volatility spike on Thursday AM and the large reversal yesterday [Friday].

[Jesse Felder referencing Tom McClellan]

'Right now, the message is that the higher highs being made by the SP500 here happening without strong liquidity, in other words this is just coming from optimism and not from money. That is a problematic way to run an uptrend.'

[Thomas Thornton, the guy who counts DeMark numbers]

"The $SPX may get the DeMark Sequential on day 12 of 13 on Monday and possibly sell Countdown 13 on Tuesday. The last sell Countdown 13 was on 12/13/22, also a CPI day.

[Ned Davis Research]:

“Ned Davis Research said on Wednesday (6/28/23) that a Fed-induced recession is the most likely risk that could derail stocks. ‘If the Fed panics and cuts rates, a blow-off bubble peak would be possible..."

[Callum Thomas]:

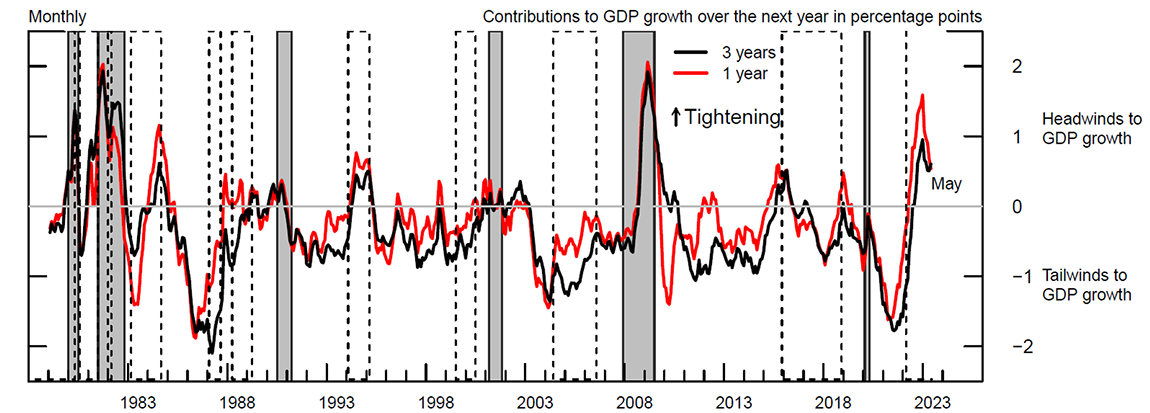

See "... how far and fast sentiment has shifted from deep pessimism to now outright optimism.

... how much longer can global equity markets defy the monetary gravity.

... if yields push further higher having broken back above the 4% level, it could rattle investors’ newfound optimism.

FROM LAST WEEK, 6/2/23

if we look at the percentage of Nasdaq stocks with negative earnings, it has just reached a new all-time high. If you argue that it is a fundamental driven rally, it ain’t showing up in the numbers (at least not yet?).

https://www.chartstorm.info/p/weekly-s- ... orm-9-july

[Lance Roberts]:

Last week he was bullish with a "potential for a 5-10% correction".

This week: "the market remains short-term overbought... but we remain bullishly positioned near term..." [but hedging for the eventual correction]

And "The US tech sector... looks simply nuts..."

And he opines on Q2 Earnings Season

https://realinvestmentadvice.com/q2-ear ... the-bulls/

[David Rosenberg; Rosie]

"When you take into account (i) back revisions, (ii) multiple-job holders and (iii) the Birth-Death model, nonfarm payrolls actually contracted in June. The recession has not been averted or avoided. The Fed will figure it out at some point but it will be too late.

[Ryan Detrick]:

"... we think strong performance can continue."

... Good chance the 209k [jobs numbers] gets revised higher.

* 1.7 millions jobs created in 2023, on the heels of the record 4.8 million last year ==> this doesn't look like a recession

"Be aware that stocks relative to bonds made another new all-time high this week. No one knows when this will stop, but until it does, OW [overweght] stocks makes a lot of sense