Page 6 of 10

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 1:45 pm

by josephli

fehro wrote:mmm .. be cautious of a sharp reversal today.. .don't like sharp down moves into lunch.. they could reverse it, short cover all afternoon and hammer the daily.. but doji the weekly.. keeps both bulls and bears in suspense over the weekend.

I think the real suspense whether there will be another capitulation just like august when market reopen next week. I am leaning towards market want to keep that suspense alive.

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 1:47 pm

by fehro

SPX .. capitulation days in the past have a similar pattern.. sharp drop in the morning reverse in the aft… vs.. down weak bounce then down into the close.. usual bear move. add to sm longs

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 1:51 pm

by fehro

SPX LOD was - 63 ish POINTS in Donald's terms.. … "that's YYUUUUUUUUGGGGEEEEE" .. yeah I know.. . 2008 days were negative 100 points

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 1:51 pm

by finman66

finman66 wrote:Open downside SPY p-bar targets at $186.34 and $186.02 and $184.00 ...... all from August 24th

For the QQQ's we have p-bars at $99.49 and $89.32 from Sept. 30 and August 24th respectively

UPDATE

First 2 SPY bars tagged and bagged ............ first QQQ p-bar missed by 2 cents ..... good enough or unfinished business

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 1:52 pm

by uempel

Posted: Fri Jan 15, 2016 1:55 pm

by MrMiyagi

- spy

Posted: Fri Jan 15, 2016 2:03 pm

by MrMiyagi

Nope.. that's it, that's as far as it will bounce back at this point...

NYDEC at 2854, unless it starts dropping, I won't believe a bounce.

Re:

Posted: Fri Jan 15, 2016 2:06 pm

by jaijailyc

From JPM research "The bigger picture fundamental backdrop hasn’t changed: the best-case multiple/earnings math (16x and $120) gets the SPX only to ~1920 and people are justified to haircut both numbers given the environment. Thus rallies should continue to get faded. For the very near-term, the risks over the next ~96 hours are prob. skewed more to the upside than the downside"

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 2:14 pm

by uempel

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 2:20 pm

by jademann

backwardation means uvxy could be up 3-5% by Tuesday just due to time decay

Re: Re:

Posted: Fri Jan 15, 2016 2:25 pm

by gappy

jaijailyc wrote:

From JPM research "The bigger picture fundamental backdrop hasn’t changed: the best-case multiple/earnings math (16x and $120) gets the SPX only to ~1920 and people are justified to haircut both numbers given the environment. Thus rallies should continue to get faded. For the very near-term, the risks over the next ~96 hours are prob. skewed more to the upside than the downside"

Historically, the average ROE has been approximately two times the long term corporate AAA bond yield - this is a key relationship.

yyy.PNG

I guess history has been discounted.

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 2:26 pm

by fehro

CPC/CPCE Put/Call ratio HOD nears extremes 1.33/1.61

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 2:32 pm

by Al_Dente

Al_Dente wrote:In all the LARGE MOVES over the last 20 trading days, only today looked like this:

The attachment 115fifteen 20day.png.png is no longer available

Update:

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 2:34 pm

by uempel

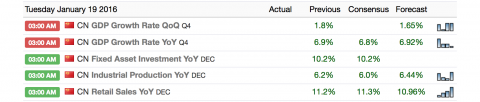

Next Tuesday is key. Whoever opens positions today should be aware that Chinese data is out Monday 9:00 p.m. EST

- Time in EST is 9:00 p.m. Monday 18th (chart shows European UTC-Time +1)

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 2:37 pm

by josephli

Al_Dente wrote:Al_Dente wrote:In all the LARGE MOVES over the last 20 trading days, only today looked like this:

115fifteen 20day.png.png

Update:

115large moves update.png.png

boss, i don't think the volume divergence means much intraday. opening and closing usually have larger volume regardless.

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 2:37 pm

by Out of Bounds

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 2:39 pm

by BullBear52x

finman66 wrote:knife-falling-freeimages.jpg

EQUALS

trauma-getty-200376418-001.jpg

Handleless knife this time.

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 2:44 pm

by Trades with cats

Last August sell off was triggered when Bridgewater and their clones got caught on their "Fed has our back" bet when both stocks and bonds dropped below their triggers and they had to dump. Only the Kardashian fan base is unaware that the market is on thin ice by all historical measures, and Bridgewater got burned last year so you know they have changed their rules. I just don't see any signs of panic, so I don't see any bottom. Besides Gandalf said go short

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 2:44 pm

by fehro

brucekeller wrote:Jeez I am so surprised at this washout given how extremely bearish the AAII was reading. Today still feels like it should bottom but it just keeps going down. I kind of screwed myself today with hardly any hedging and a lot of same week options. :\

download the excel info.. and look into the yearly lows, the deep lows during sharp pull backs.. have higher/deeper readings.. but "think" we may bounce into the close.. fwiw.

Re: 01/15/2016 Live Update

Posted: Fri Jan 15, 2016 2:44 pm

by Cobra

100% mm up?