Page 2 of 5

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 11:55 am

by Trades with cats

Smalls back into the green and just into the daily statistical noise range (1393 to 1396.4 today RTH)

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 11:58 am

by Al_Dente

Trades with cats wrote:Smalls back into the green and just into the daily statistical noise range (1393 to 1396.4 today RTH)

sorry boss, tell me again, what is "RTH"

thanks

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 12:00 pm

by Trades with cats

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 12:09 pm

by Trades with cats

RTH seems to be shorthand for regular trading hours, or the old open outcry market. I guess the overnight stuff should be called Globex because the extended hours handle seems to mean the extra 15 minutes after the floor traders stop.

Fat Tails (Henry in Berlin) daily weekly and monthly pivots, VWAP and high low close ADR indicators can all be set for any and all trading hours. He suggests using the hours where the bulk of trading goes on.

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 12:21 pm

by Trades with cats

- I minute ES RTH

VWAP, Daily floor pivots, open high low and average range.

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 12:31 pm

by Al_Dente

Quickie guide to who is dominant

Pink is wussie intraday today... so far...

One min

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 12:41 pm

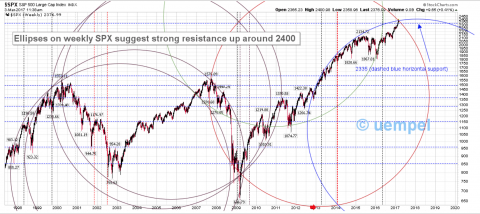

by uempel

Ellipses on long term weekly SPX suggest that it's unlikely 2400 will be busted anytime soon.

- SPX weekly log

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 12:41 pm

by Al_Dente

This right here is another opportunity for IWM to double bottom

Let’s see if she takes the bait

5min

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 12:50 pm

by champix

My long term chart for ES (continuous) with channels.

Yellow channel has stoped the bulls for the moment. 2370 on ES should be a good support today, MA9 days.

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 1:03 pm

by Cobra

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 1:05 pm

by Cobra

for now it looks like a bear flag, just nowadays most bear flags turn into V shape bottoms so hard to trust what I see.

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 1:05 pm

by Al_Dente

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 1:14 pm

by BullBear52x

No new LOD from here I will be very disappointed in bears

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 1:17 pm

by BullBear52x

5 DMA support, last stand for short term bulls.

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 1:20 pm

by Trades with cats

new low ? Well FOMC Evans was concerned about inflation, sounding dovish. Vice-Chair Fisher is up at 12:30 and is a Hawk so if he sounds soft we could see a reaction. But I have no idea at this point which way the markets will move if they do not raise. It is that game, what do you think everyone else is thinking.

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 1:21 pm

by Al_Dente

Hey SNAP how u doin’

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 1:32 pm

by Trades with cats

Well so much for that. Fisher does not comment on rate outlook in his prepared statement.

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 1:40 pm

by BullBear52x

once the /DX traded lower than 102.05, I know the correction in /DX is not good sign for rate increase talk. will see. right now /DX is on sell mode short term, so is /ES under 2380.

/ES 2380 is key pivot on short term as of today.

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 1:40 pm

by Al_Dente

Anyone with link to janet live, please post soon

Re: 03/03/2017 Live Update

Posted: Fri Mar 03, 2017 1:43 pm

by Trades with cats

I think it is a requirement for Chair Yellen to confuse the markets at this point and "keep em guessing". If I am right then we sink into a boring range.