Page 2 of 2

Re: 09/08/2012 Weekend Update

Posted: Sat Sep 08, 2012 9:15 pm

by ClarkW

I've posted this chart before. $SSEC Bullish Gartley is here. Anytime you are looking for a trend to reverse the question is what's the catalyst. Did we get it with the infrastructure spending announcement this past week? Time will tell.

The next question is what to buy to play it? Below is a chart of $SSEC showing the Gartley pattern along with some China ETF's and their correlation to $SSEC. PEK seems to be the only China ETF I could fine that has a good correlation. It's a diversified ETF with a nice dividend (

http://www.vaneck.com/funds/PEK.aspx but it's very thinly traded. FXI as you see has a horrible correlation. Will look at dabbling in some PEK beginning of the week with a tight stop.

DISCLOSURE: I'M NOT A HARMONICS EXPERT, IN THE 1ST INNING OF LEARNING. DO NOT FOLLOW, NOT A RECOMMENDATION.

Re: 09/08/2012 Weekend Update

Posted: Sat Sep 08, 2012 9:20 pm

by Cobra

ClarkW wrote:Cobra wrote:If you're StockCharts member, please do me a little favor by "vote" and the most importantly "follow" my public chart list here: http://stockcharts.com/public/1684859. You need "follow" only once but vote can be done everyday, so whenever you have time, please vote for me, thanks! If you're not StockCharts member, you can also help boosting my rank by clicking the link once everyday.

The only important chart I think worth attention is below. Not extreme enough so I don't mean bear, I just think it's time to pay attention.

Outstanding job as always Cobra! You do an amazing job of teaching! Can't remember when I found you, year or so ago, but don't think there's been a day that I'm not on your site. Very grateful!

Dr. Al, Great job as well! My "Al Dente" folder in stockcharts.com is piling up! Full of great stuff! Now if you and Cobra could only help me control my emotion and weird desire to try and pick bottoms/tops

Thanks.

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 12:59 am

by Cobra

here's some weekly stock picks for fun:

viewtopic.php?f=10&t=666&p=93859#p93859

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 9:06 am

by Harapa

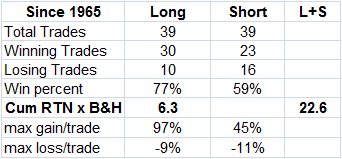

For LT only and further research:

SPY-TRIN based model turned positive last week.

This

can be

can be

a good substitute for B&H strategy.

- Performance of SPY_TRIN setup.png (5.12 KiB) Viewed 9065 times

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 11:11 am

by KeiZai

Hello weekenders, here is my take

Very bullish in red, bearish in green

Best correlation in risk ON/OFF I found in CAD/JPY pair

Short-term CAD/JPY

Bigger picture

Nothing new in dollar index, 78-77 will be crucial for next move in dollar...To be honest I am not absolutely sure anymore in the C-wave up...CB´s are da boss, well it is what it is buds

viewtopic.php?f=2&t=659&p=93052#p93052

Euro = bullish, bullish, bullish....minimum target 1.34 IMHO

Overall market picture = bullish, ECB’s decision to allow unlimited purchases of sovereign debt is a significant change in the risk!

GL all

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 12:09 pm

by shaca

WTIC did 3 weekly reversal bars

maybe 1450 a top on sp500? macd/ppo divergence

this is also interesting

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 12:28 pm

by Al_Dente

Given the accepted notion that dividend-paying stocks are “relatively safer” than a balanced, equal-weighted SPX portfolio (which is “relatively riskier”),

the DVY/SPXEW ratio helps take the temperature of safety v risk.

This chart is WEEKLY.

Since about Feb 2011 dividend stocks have been in an uptrend channel, showing investors’ preference for portfolio income. But the recent favoring of dividends is not just risk–aversion, it is also speaks to the lousy alternative of near-zero rates on gov bonds for income-chasing investors.

Anyway, the ratio may now be at a critical juncture (blue circle). If (that’s a BIG IF) it breaks down, that would mean folks are letting go of their “safer” div stocks in favor of a broader SPX portfolio = bullish SPX

LONGER TERM. If (IF) it holds trend and continues up = bearish for broader SPX.

Also: you can see where the red boxes show the DVY moving up when investors get a whiff of an SPX decline. Astonishingly, in the depths of the 2008 crash,

it was this ratio that signaled as early as December 2008, that investors were starting to move out of dividends into “riskier” SPX stocks, and that was one of a precious few believable early signals that a true SPX bottom was near.

Please post alternative interpretations.

PAGING JOE JOE GAMMA hi there

What page? My only page is the Cobra

Nina:

http://www.youtube.com/watch?v=IJv-siu5FXY

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 12:48 pm

by BullBear52x

Great charts, thank you all.

Copper a little room to go before hitting resistance?

USO not exciting here a little stalling

what about DBA should it hit new high if inflation really pick up the speed?

DBV about to retest down trend resistance.

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 1:03 pm

by Al_Dente

McClellan just chimed in on the election-year-chart chatter:

http://www.mcoscillator.com/learning_ce ... fferences/

“…this version of the Presidential Cycle Pattern says that we should expect to see a choppy uptrend continuing toward election day, perhaps with some significant "texture" along the way. The strong correlation up until now suggests that this pattern is working reliably. Once we see how the election turns out, we can then figure out which pattern to follow starting in November…”

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 1:16 pm

by BullBear52x

Monday game plan, swing =

Buy, intraday = Sell the rips.

Friday internals other then SPY everything else got sell triggered, so from that reading a trade higher will trigger sell on SPY. no tick nor ding as of now for SPY, good luck all in the week to come.

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 1:42 pm

by Al_Dente

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 1:46 pm

by KeiZai

Al_Dente wrote:McClellan just chimed in on the election-year-chart chatter:

http://www.mcoscillator.com/learning_ce ... fferences/

“…this version of the Presidential Cycle Pattern says that we should expect to see a choppy uptrend continuing toward election day, perhaps with some significant "texture" along the way. The strong correlation up until now suggests that this pattern is working reliably. Once we see how the election turns out, we can then figure out which pattern to follow starting in November…”

Great thanks Al, if the 1st termer from new party will play out it would be really breathtaking how nicely we are copying cycle from 70´s

few pics for those who are not familiar with cycles (to know what I am talking about)

- 2-SP-500-2008.gif (9 KiB) Viewed 8981 times

And here is the recovery phase - note the super similarity with the green line from the article!!

AMAZING

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 2:56 pm

by ocassional observer

china and europe seems like better value now than the us. outright QE seems to be a bit premature now, not to mention it would leave the fed with dry powder afterwards. i think some extension of rate rise and strong wording will be all we get. the china stimulus can help base metals in the short term, but it's not a game changer. i believe hard commodities will tumble some 50% when all is said and done in china, but it will take several years. the draghi program lifts the risk to the banks on the expense of more taxes on the public. the "save the bankers, screw the citizens" theme continues unabated. european markets might rejoice for a while, until the reality of the further austerity that comes with this program is understood. spain just hiked VAT on basically anything, trippling the rate for some products. that will surely lead to growth there...

the german constitutional court will approve the esm but with strict conditions that will chain merkel's hands further. sentiment against bailouts is running high in germany, and anti-euro sentiment is running high in italy and holland. holland goes to election on the 12 as well. a win for anti euro party can tank the markets in this fragile overbought state.

vxo:rvx continues calling for a top:

sentiment is way too exuberant, but the TIM market sentiment (formerly first coverage) which measures analyst opinions has dropped below 50 for the first time since april 2009 when it moved above 50 at the start of the rally:

and currently:

http://online.barrons.com/public/page/9 ... dings.html

basically the market is now hung only on central bankers to save him, while the economy is looking decisively worse than last year.

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 4:31 pm

by Harapa

Thanks.

VIXIES in hourly mode can do.

VIX futures (next month expiration) or VXV offer a better entry exit points in one hour time frame vs VIX and its ETNs. Price for VIX futures is price of next month contract. System switches to next month contract on Wednesday of the week of options expiration. Dip/sell ~ mid Aug is due to this switch. While this may appear odd, market tends to be soft/hot in the next 5-10 days if VIX futures price takes a big jump on this day (this aberration/jump is not seen in VIX or its ETNs or even in VXV as their price is an average/median

of 30 or 90 day forward contracts). Over the long term performance of signals derived from VIX futures offer a "substantial" advantage over VXX or VIX.

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 7:00 pm

by Al_Dente

Harapa wrote:VIX futures (next month expiration) or VXV offer a better entry exit points in one hour time frame vs VIX and its ETNs. Price for VIX futures is price of next month contract. System switches to next month contract on Wednesday of the week of options expiration. Dip/sell ~ mid Aug is due to this switch. While this may appear odd, market tends to be soft/hot in the next 5-10 days if VIX futures price takes a big jump on this day (this aberration/jump is not seen in VIX or its ETNs or even in VXV as their price is an average/median

of 30 or 90 day forward contracts). Over the long term performance of signals derived from VIX futures offer a "substantial" advantage over VXX or VIX.

HARAPA Thanks

I only understood half of what u just said. I think we r close to same page but u r over my head.

I’m working on my 60min vixies (thx 2 u) and like their swing signals (for spx proxies) better than my daily…. so far…

Still a work in progress…

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 7:24 pm

by ZimZeb

Al_Dente wrote:the DVY/SPXEW ratio helps take the temperature of safety v risk.

Fun one to play with A_D!

Also notice the 52 wSMA support.

Flipped it and poked around with Aroon.

In the last five years, the $SPXEW:DVY 26w Aroon Down has directly gone from zero, crossed $SPXEW:DVY Aroon Up, and then hit 100 three different times: July-September 2008, May-June 2011, and June-July 2012. The third example did diverge from the first two in making a new $SPX high relative to the time of the preceding $SPXEW:DVY Aroon Up peak (March 2012, <100). The Aroon whipsaw before/during the flash crash prevented a fourth instance. Speaking of...kinda looks like a p-bar, eh?

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 7:40 pm

by 3DM

Hello weekenders,

Copper daily chart closed above 200 day average. Copper weekly chart closed above 50 week average.

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 9:13 pm

by jimme

WOW!! Stock picks by my Main Man. I actually bought ENTR calls last Thursday and JBLU calls similar to your LCC. I watch everyday but can't post. The contributions by ALL are remarkable and thanks for taking the time to comment during each day. The market is going to grind around for awhile but some of these stocks will do much better. Thanks again for the nice list! Carry on. GLTA Jimme

jimme Posts: 230Joined: Sat Nov 05, 2011 9:45 pm

Re: 09/08/2012 Weekend Update

Posted: Sun Sep 09, 2012 11:28 pm

by Harapa

Al_Dente wrote:Harapa wrote:VIX futures (next month expiration) or VXV offer a better entry exit points in one hour time frame vs VIX and its ETNs. Price for VIX futures is price of next month contract. System switches to next month contract on Wednesday of the week of options expiration. Dip/sell ~ mid Aug is due to this switch. While this may appear odd, market tends to be soft/hot in the next 5-10 days if VIX futures price takes a big jump on this day (this aberration/jump is not seen in VIX or its ETNs or even in VXV as their price is an average/median

of 30 or 90 day forward contracts). Over the long term performance of signals derived from VIX futures offer a "substantial" advantage over VXX or VIX.

HARAPA Thanks

I only understood half of what u just said. I think we r close to same page but u r over my head.

I’m working on my 60min vixies (thx 2 u) and like their swing signals (for spx proxies) better than my daily…. so far…

Still a work in progress…

99wkndvixb.png

What I was trying to explain was "as to why FIX futures gave better results", which I suppose didn't succeed in communicating.

I see you are homing in the same zones as my setup does. I would like to know your final settings so that I can look at these next to mine (no rush, whenever you think these are final). In the interim, I will post hourly signal here whenever it happens so that you can compare it with yours.

Also, could you please PM me EMA settings for 5 min XIV chart for intraday trading that you shared with me recently. Thanks.

Re: 09/08/2012 Weekend Update

Posted: Mon Sep 10, 2012 10:51 am

by Cobra

false breakout, I won't read much yet but disappointing...