Page 2 of 11

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:17 am

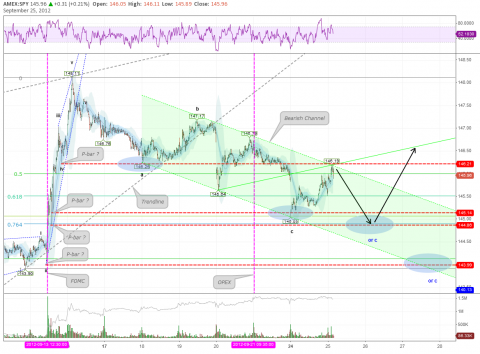

by BullBear52x

GM, Chart pattern, looks like the up arrow is destined.

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:20 am

by Cobra

very small double top (twzzer top), so might see pullback here, I just wish the pullback won't be too large.

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:21 am

by BullBear52x

VIX is at support or SPY:VIX is at resistance, wait for all this to cool down first I guess.

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:21 am

by noob

Cobra wrote:very small double top (twzzer top), so might see pullback here, I just wish the pullback won't be too large.

If large then retest of the overnight high failed?

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:29 am

by Mario TR

- SPY - 5 min

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:31 am

by Bman69

Check GOOG guys, 8 or 9 days up in a row, above upper bollinger band, MACD max'd, would expect a pull back here. Have gone short.

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:31 am

by TWT

SPX: I maintain the short term map as long as < 1467

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:33 am

by TradingJackal

Folks,

Gap up when not many expected. Bears fighting the inevitable. Though institutional investors are showing distribution, the price is not going down as much. The $2 billion a day seems to be working out OK. Someone mentioned rebalancing portfolios before the end of the quarter (was it Al?) that seems to make sense from the market behavior. I say we go higher before Europe closes.

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:34 am

by ocassional observer

the philly fed state coincident indexes were released today. I've discussed them a month ago, so to sum it up: a level of under 50 in the 3 month diffusion index usually occurs only before recessions. a level of 30 or less occurs usually at recessions:

h[url]ttp://1.bp.blogspot.com/-Aut9ntaINrs/UDOX5jhd4cI/AAAAAAAAPnQ/37kai25t3iM/s1600/PhillyFedStateJuly2012.jpg[/url]

the july level was 34, august's level is 24. i believe the us is entering a recession right now, and ECRI and Hussman will be vindicated in the future (although their initial timing was wrong). considering the lowered guidance, lowered estimates and probably lower government spending next year, the market is now relying solely on the fed for rescue. i don't believe liquidity alone will be enough to justify the earnings multiples that will be required to maintain current levels.

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:36 am

by Cobra

pullback as expected, now support area. wait.

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:48 am

by ocassional observer

i've put the map of dec 2007 (start of last recession) vs aug 2012 for better visual of what i stated:

there are 16 red and pinks now vs 12 in dec 07.

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:55 am

by BullBear52x

intraday, SPY:VIX double top, intaday can be all kind of crazy opportunities

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:57 am

by fehro

triangle still in play?

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 10:59 am

by fehro

longer trends

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 11:00 am

by Petsamo

ocassional observer wrote:i've put the map of dec 2007 (start of last recession) vs aug 2012 for better visual of what i stated:

coincident indexes dec 2007 vs aug 2012.png

there are 16 red and pinks now vs 12 in dec 07.

I was half asleep during ECON 102

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 11:03 am

by noob

Cobra wrote:pullback as expected, now support area. wait.

Wow target hit exactly.

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 11:06 am

by Cobra

well, at least target reached. wait. a consolidation here would be perfect.

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 11:10 am

by Mongoose

It is far too early to hail Draghi's plan as a solution to the crisis.

The central bank has bought no bonds yet and its members are already sending conflicting signals over how the plan will be implemented.

http://www.reuters.com/article/2012/09/ ... 9A20120925

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 11:13 am

by TraderGirl

SPY...sitting at resistance....

Re: 09/25/2012 Live Update

Posted: Tue Sep 25, 2012 11:18 am

by Al_Dente

Relative strength

The OEX drop is unusual

It may be the asset-allocation portfolios divesting some stocks for quarter-end

They have until Friday to re-balance