Page 3 of 4

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 1:25 am

by knock

I've noticed this for a while. This drawing is not accurate. The top is around 1488, not the QE3 top. Let's relax and enjoy the climax.

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 2:25 am

by Seawaves

I also believe there is at least another wave up, and it's cleaer when looking at QQQ and RUT than SPX.

DH is good at price levels but rarely makes prophecy, probably he has figured out the Street is using QE money for shorting this time.

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 3:26 am

by ZimZeb

Another weekly installment of "things stolen from Al_Dente."

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 3:31 am

by ZimZeb

knock wrote:This drawing is not accurate. The top is around 1488,

1576.09 - 768.63 = 807.46

1474.51 - 666.79 = 807.72

Are you getting 1488 by some other method, or is my arithmetic off?

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 6:19 am

by nasta

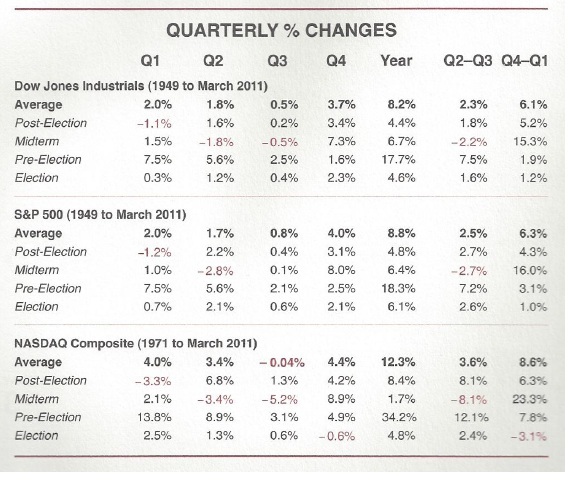

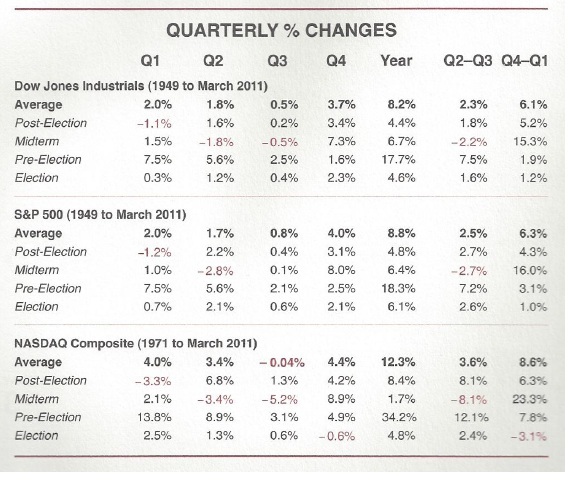

Jeff Hirsch, Author of the annual Stock Traders Almanac, put out a friendly reminder last week about the final stages of Election years. Historically, Q4 the year of an election and Q1 of the following year represent the second worst two-quarter combination of the entire 4-year cycle.

History Says To Be Careful At The End Of Election Years

History Says To Be Careful At The End Of Election Years

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 12:49 pm

by Seawaves

ZimZeb wrote:knock wrote:This drawing is not accurate. The top is around 1488,

1576.09 - 768.63 = 807.46

1474.51 - 666.79 = 807.72

Are you getting 1488 by some other method, or is my arithmetic off?

using parallel lines. see the top ceiling white line in the chart!

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 12:53 pm

by KaZoom

This LOG scale long-term medianline view of SSEC (Shanghai) suggests a climb to at least next spring.

The wedge should break up and follow the green medianline to at least the blue arrow.

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 12:56 pm

by KeiZai

daytradingES wrote:KeiZai wrote:Iron ore and etc traders my short-term take on Rio Tinto (price in pound sterling)

The attachment RT13.png is no longer available

Thanks for the Rio chart Keizai!

Sorry to be a dim bulb but do you read your chart that it will go down?

I read an article - perhaps at zero hedge? - that the only thing you needed to track the health of the economy of China (and since the world seems to be banking on then correspondingly the health of the world recovery) was the demand for iron and so a chart of the price of iron was all you need!

Yes I favor C wave down in risk this week because of dollar, but the tricky thing with C-waves is that they are contratrendish and that´s why they use to fail (truncated c) The key to watch this week is definitely dollar...I have prepared trading plan4both scenarios

U are absolutely right with China I posted this chart about Rio last month, that it´s all about china

U can see there nice H&S top pattern but I don´t think will be triggered although I have big P-bar into H&S target area and a bit deeper in very reliable platform

Eurostoxx chart (prior plan one more leg down in risk)

FTSE (secondary plan - in the case of failed C wave down)

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 12:58 pm

by KeiZai

KaZoom wrote:ssec.png

This LOG scale long-term medianline view of SSEC (Shanghai) suggests a climb to at least next spring.

The wedge should break up and follow the green medianline to at least the blue arrow.

I love this kind of charts, big thanks...Andrew rulez

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 1:14 pm

by KaZoom

KeiZai wrote:

I love this kind of charts, big thanks...Andrew rulez

I find it fascinating when a LOG scale fork is so well respected.

I've also seen LOG fibs turn the trend on long-term charts.

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 1:57 pm

by Al_Dente

Great charts this weekend

THANKS TO ALL

Many charts show support. Some charts are so advanced that understanding them is a supreme challenge

Here is a chart for beginners and intermediates and simple country folks like the dente

GL2all

"What are we doing here, that is the question. And we are blessed in this, that we happen to know the answer.

Yes, in the immense confusion one thing alone is clear. We are waiting for Godot to come.” [Samuel Beckett]

Brubeck:

http://www.youtube.com/watch?v=vmDDOFXSgAs

ps BB52x soooooooo glad u r back

ps DR X nice 2 see u. how are yr elders??

ps zimzeb thanks

etc etc

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 2:01 pm

by BullBear52x

Al_Dente wrote:Great charts this weekend

THANKS TO ALL

Many charts show support. Some charts are so advanced that understanding them is a supreme challenge

Here is a chart for beginners and intermediates and simple country folks like the dente

GL2all

1014wkndsimple.png

"What are we doing here, that is the question. And we are blessed in this, that we happen to know the answer.

Yes, in the immense confusion one thing alone is clear. We are waiting for Godot to come.” [Samuel Beckett]

Brubeck:

http://www.youtube.com/watch?v=vmDDOFXSgAs

ps BB52x soooooooo glad u r back

ps DR X nice 2 see u. how are yr elders??

ps zimzeb thanks

etc etc

LOL Dr. Al, Thanks I never left, I just in different focus

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 2:09 pm

by BullBear52x

KaZoom wrote:KeiZai wrote:

I love this kind of charts, big thanks...Andrew rulez

I find it fascinating when a LOG scale fork is so well respected.

I've also seen LOG fibs turn the trend on long-term charts.

Here is my pick of the day FXI, selling Monday will get a 1-2% head start, early bird extreme counter trend. see CCI and BB% ( classic exhaustion volume ) break out line as support, if fail there it will turn out to be a home run. I am eyeing Monday.

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 2:27 pm

by BullBear52x

Friday gap run on Tranny throw off Dow theorists to what now? well, here my take on IYT, 1 min. bear flag, 5 and 10 min. looking to 5dma, daily bearish, looking for 5dma for support, if fails there bears will hit the beach. iMHO

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 2:29 pm

by Al_Dente

BullBear52x wrote:Al_Dente wrote:Great charts this weekend THANKS TO ALL...blablabla

ps BB52x soooooooo glad u r back...

LOL Dr. Al, Thanks I never left, I just in different focus

hahaha bb focus this:

http://www.youtube.com/watch?v=wKJmuViL ... re=related

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 2:34 pm

by BullBear52x

Here is my SPY and IWM fib targets. not healthy as most will see short term but your guess is good as mine what is behind door number 3

have a great week all.

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 2:36 pm

by BullBear52x

Al_Dente wrote:BullBear52x wrote:Al_Dente wrote:Great charts this weekend THANKS TO ALL...blablabla

ps BB52x soooooooo glad u r back...

LOL Dr. Al, Thanks I never left, I just in different focus

hahaha bb focus this:

http://www.youtube.com/watch?v=wKJmuViL ... re=related

Hmm...gtg

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 2:52 pm

by Al_Dente

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 4:33 pm

by kongen

Oh, yuk! Extreme saccharinity!

Re: 10/13/2012 Weekend Update

Posted: Sun Oct 14, 2012 5:15 pm

by daytradingES

ClarkW wrote:

Great stuff, daytradingES!

Many thanks Clark!