Page 1 of 2

09/14/2013 Weekend Update

Posted: Fri Sep 13, 2013 7:13 pm

by Cobra

This week's story is AAII back to a little extremely bullish, but I don't see smart money added any more short, so guess nothing wrong for bulls yet.

Re: 09/14/2013 Weekend Update

Posted: Fri Sep 13, 2013 7:17 pm

by Cobra

The other 2 usual weekly updates don't say anything useful. The institutional buying and selling actions chart is from stocktiming while the II chart is from sentimentrader.

Re: 09/14/2013 Weekend Update

Posted: Fri Sep 13, 2013 7:27 pm

by Cobra

Summary of the weekly stock picks. Not a bad week.

viewtopic.php?f=10&t=1052&p=142143#p142143

Re: 09/14/2013 Weekend Update

Posted: Fri Sep 13, 2013 8:29 pm

by xfradnex

Re: 09/14/2013 Weekend Update

Posted: Sat Sep 14, 2013 10:29 am

by uempel

I've been following this indicator for a few days and so far it looks as though it's a dud...

Close-up:

Can you make Money using MA 21/55 Cross

Posted: Sat Sep 14, 2013 11:49 am

by Harapa

uempel wrote:I've been following this indicator for a few days and so far it looks as though it's a dud...

The attachment 22.png is no longer available

Close-up:

The attachment 33.png is no longer available

humm!

Plot on the left shows signals and one the right shows growth of $1000 invested in SPY based on 21/55 cross since year 1993. Trade is opened/closed on the next day open following the 21/55 cross. The return of this setup is less than 40% of B&H. This setup, some time helps to control the draw downs in the bear market;in 2000-2003 the draw down was similar to B&H (~35%) but less(~25%) in 2008-2009 period.

May be you want to look at MA12/72 cross. Application of this combo fetches 110% of B&H with smaller draw downs. Is 12/72 a magic number? No way, just a combo that my "MA Cross Optimizer" identified.

Re: 09/14/2013 Weekend Update

Posted: Sat Sep 14, 2013 11:55 am

by Cobra

Weekly stock picks now is for members only. Here's the preview.

viewtopic.php?f=10&t=1059&p=142148#p142148

Re: 09/14/2013 Weekend Update

Posted: Sat Sep 14, 2013 11:57 am

by uempel

Next week is going to be very exciting

Re: 09/14/2013 Weekend Update

Posted: Sat Sep 14, 2013 12:28 pm

by uempel

Thanks Harapa, thanks for your input.

But pls note that I'm only looking at the "sell signals" (21 crosses 55 to the downside) and I'm looking specifically at clusters of sell signals - like in 2007, 2010 and 2011. Why 21/55? Many traders respect these MAs (of course 20/50 too) as "significant trading signals", so crossovers might have some significance. Frequent crossovers could signal high nervousness in the market, a possible change of the medium term direction

Of course I know it, this is purely hypothetical guesswork

Something which is not guesswork: next week will be very exciting, see the chart I posted half an hour ago

-

Re: 09/14/2013 Weekend Update

Posted: Sun Sep 15, 2013 10:39 am

by DellGriffith

There is an ominous head and shoulders pattern on the Dow going back to May. But, my composite signal turned bullish. What to do? Well, I've learned over the years to trust my signal, and it says to buy on Monday, so I will do that.

This doesn't mean the head and shoulders is WRONG. What usually happens when my signal turns bullish is the market gaps down on the open on the buy day. Usually buy day is about filling my order before it closes the gap. So maybe we just gap down early, rally up, and then hover flat at that price level (or trade in a tight range?) for a few weeks to carve out the second shoulder of the pattern. That would satisfy both my signal and the technical chart. Just spitballing.

Anyway, I buy on Monday morning... Wish me luck!

Re: 09/14/2013 Weekend Update

Posted: Sun Sep 15, 2013 12:31 pm

by Ratbastrd

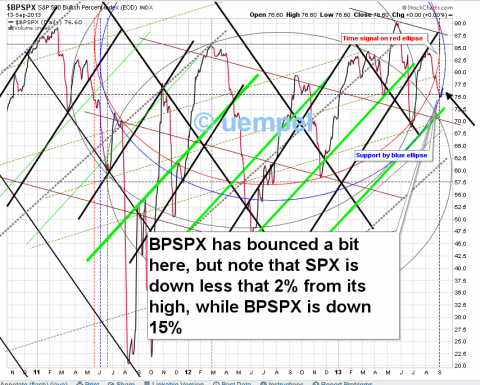

Would be interested in feedback from the board here. Stumbled across this the other day when looking at internals. I noticed the big divergence between SPX and BPSPX. I have measured this with correlation SPX below the main section of the chart. Current reading is -.11

http://stockcharts.com/h-sc/ui?s=$BPSPX ... =258748664

Here is where this gets interesting, I have looked back 20 years. This condition has only occurred a handful of times in the last 20 years (15+ times or so). The condition doesn't last very long (a few days) and in almost every case was followed by a rapid but short correction 50 points on average, a few times larger. A few times the divergence grew (but that is improbable here I'll explain below)

The occurrences seem to come in swarms, typically as markets are reaching major tops, and there are years between instances.

Here is the cool part, to resolve the correlation issue, either asset managers start buying large quantity of stock across the board to bring the bullish percentages up, or the market sells off to bring the correlation back in order.

Problem is a major rally here is highly improbable given the location of the daily/weekly/monthly Bollinger bands (daily BB top =1692) (weekly bb top= 1715) (monthly top 1718).

http://stockcharts.com/h-sc/ui?s=$SPX&p ... 4061871527

Curious if anyone see's an alternative outcome here. This is one of the most obvious tells I have seen in a long time.

Re: 09/14/2013 Weekend Update

Posted: Sun Sep 15, 2013 1:25 pm

by BullBear52x

Bears wishful thinking chart, this week or next week a lower high of red elder impulse will be a bless

but for that to happen I would think these simple indicators to turn down first so far that is not the case (yet)

I can see weakness on QQQ and IWM short term (secret holy grail indicators)

for the week to come the leaders will be a tell, AAPL you know what happen to it, NFLX, TSLA, GOOG, AMZN.....if these guys turn there will be few places to hide. my Chart of the day goes to GOOG, bear flag and a confirmation of bigger down trend to come if breaks here.

Re: 09/14/2013 Weekend Update

Posted: Sun Sep 15, 2013 1:59 pm

by BullBear52x

Lets talk bears this week, since bulls are fat, bored, and complacent.

Here is some idea of where bears can pick a fight with.

Re: 09/14/2013 Weekend Update

Posted: Sun Sep 15, 2013 2:35 pm

by knock

Let's see if this plays out.

Re: 09/14/2013 Weekend Update

Posted: Sun Sep 15, 2013 2:49 pm

by BullBear52x

Ratbastrd wrote:Would be interested in feedback from the board here. Stumbled across this the other day when looking at internals. I noticed the big divergence between SPX and BPSPX. I have measured this with correlation SPX below the main section of the chart. Current reading is -.11

http://stockcharts.com/h-sc/ui?s=$BPSPX ... =258748664

Here is where this gets interesting, I have looked back 20 years. This condition has only occurred a handful of times in the last 20 years (15+ times or so). The condition doesn't last very long (a few days) and in almost every case was followed by a rapid but short correction 50 points on average, a few times larger. A few times the divergence grew (but that is improbable here I'll explain below)

The occurrences seem to come in swarms, typically as markets are reaching major tops, and there are years between instances.

Here is the cool part, to resolve the correlation issue, either asset managers start buying large quantity of stock across the board to bring the bullish percentages up, or the market sells off to bring the correlation back in order.

Problem is a major rally here is highly improbable given the location of the daily/weekly/monthly Bollinger bands (daily BB top =1692) (weekly bb top= 1715) (monthly top 1718).

http://stockcharts.com/h-sc/ui?s=$SPX&p ... 4061871527

Curious if anyone see's an alternative outcome here. This is one of the most obvious tells I have seen in a long time.

nice finding, here is my internals, from these reading I can not be overly bearish, especially summation index and record high percent index the way they are now. these guys must be weak enough, for now the summation index is below zero but still green, $RHNYA need to be below 50% before bearish trend can sustain, and look at the rest of my chart here, these are end of day data so they may be lagging a bit.

Re: 09/14/2013 Weekend Update

Posted: Sun Sep 15, 2013 2:55 pm

by BullBear52x

knock wrote:Let's see if this plays out.

oy!

Re: 09/14/2013 Weekend Update

Posted: Sun Sep 15, 2013 4:28 pm

by uempel

Ratbastrd, this BPSPX chart was posted yesterday in Cobra's blog:

Ratbastrd wrote:Would be interested in feedback from the board here. Stumbled across this the other day when looking at internals. I noticed the big divergence between SPX and BPSPX. I have measured this with correlation SPX below the main section of the chart. Current reading is -.11

http://stockcharts.com/h-sc/ui?s=$BPSPX ... =258748664

Here is where this gets interesting, I have looked back 20 years. This condition has only occurred a handful of times in the last 20 years (15+ times or so). The condition doesn't last very long (a few days) and in almost every case was followed by a rapid but short correction 50 points on average, a few times larger. A few times the divergence grew (but that is improbable here I'll explain below)

The occurrences seem to come in swarms, typically as markets are reaching major tops, and there are years between instances.

Here is the cool part, to resolve the correlation issue, either asset managers start buying large quantity of stock across the board to bring the bullish percentages up, or the market sells off to bring the correlation back in order.

Problem is a major rally here is highly improbable given the location of the daily/weekly/monthly Bollinger bands (daily BB top =1692) (weekly bb top= 1715) (monthly top 1718).

http://stockcharts.com/h-sc/ui?s=$SPX&p ... 4061871527

Curious if anyone see's an alternative outcome here. This is one of the most obvious tells I have seen in a long time.

Re: 09/14/2013 Weekend Update

Posted: Sun Sep 15, 2013 4:32 pm

by uempel

Bullbear 52x, Ratbastrd writes: ...a rapid and short correction....

Might be a intraweek matter.

Re: 09/14/2013 Weekend Update

Posted: Sun Sep 15, 2013 5:13 pm

by BullBear52x

uempel wrote:Bullbear 52x, Ratbastrd writes: ...a rapid and short correction....

Might be a intraweek matter.

I got what the rat were saying,

see here when the Summation index <0 Maybe its over already?

Barbequed Bear will be Served

Posted: Sun Sep 15, 2013 6:15 pm

by Harapa