Page 1 of 2

07/12/2014 Weekend Update

Posted: Fri Jul 11, 2014 4:21 pm

by Cobra

The institutional buying and selling chart (courtesy of stocktiming) shows more accumulation but the distribution is rising fast and accumulation is falling fast. Interesting.

Smart money shorted a little bit, nothing bad yet.

I see nothing on AAII. More bulls but I'd like to see extremely extreme, for now it's far from extreme.

Have a good weekend everyone!

Posted: Fri Jul 11, 2014 4:25 pm

by MrMiyagi

- spy5

Re: 07/12/2014 Weekend Update

Posted: Fri Jul 11, 2014 4:28 pm

by Cobra

Re: 07/12/2014 Weekend Update

Posted: Fri Jul 11, 2014 6:15 pm

by Cobra

Re: 07/12/2014 Weekend Update

Posted: Fri Jul 11, 2014 7:20 pm

by Heck

Cobra wrote:The institutional buying and selling chart (courtesy of stocktiming) shows more accumulation but the distribution is rising fast and accumulation is falling fast. Interesting.

inst b sell.png

Smart money shorted a little bit, nothing bad yet.

SmartMoney.png

I see nothing on AAII. More bulls but I'd like to see extremely extreme, for now it's far from extreme.

AAII.png

NYSI Sell Signal:

http://stockcharts.com/public/1684859/chartbook

Keep up the great work

Re: 07/12/2014 Weekend Update

Posted: Fri Jul 11, 2014 8:04 pm

by Cobra

Heck wrote:Cobra wrote:The institutional buying and selling chart (courtesy of stocktiming) shows more accumulation but the distribution is rising fast and accumulation is falling fast. Interesting.

inst b sell.png

Smart money shorted a little bit, nothing bad yet.

SmartMoney.png

I see nothing on AAII. More bulls but I'd like to see extremely extreme, for now it's far from extreme.

AAII.png

NYSI Sell Signal:

http://stockcharts.com/public/1684859/chartbook

Keep up the great work

NYSI sell signal doesn't matter. It only means the up momentum is weakening but it doesn't mean the actual price would fall. Momentum equals to acceleration. Acceleration is decreasing doesn't mean speed wouldn't go up. So forget about NYSI sell.

Re: 07/12/2014 Weekend Update

Posted: Fri Jul 11, 2014 8:56 pm

by Al_Dente

One month performance

Dow stocks with the highest beta

With INDU in lime green for comparison

Re: 07/12/2014 Weekend Update

Posted: Sat Jul 12, 2014 12:53 pm

by Al_Dente

Excerpts from the Kirk Report, as posted at the Slope

Posted: Sat Jul 12, 2014 2:36 pm

by tsf

Excerpts from the Kirk Report, as posted in the comments section of the Slope today July 12:

No Bullish Or Bearish Setups In Motion But Two Things To Watch: Last week's pullback did not create or trigger any new bullish or bearish setups. However, we are watching a couple of things here technically:

1) Bearish Head Type Reversal: First, on the 30 minute view, we are wondering if this is a bearish head type reversal. To have confidence in that we would have to see last week's low taken out and move down to the

June 26th low around S&P 1944.

2) Repeat Bullish Inverse H&S Setup: With the bounce from Thursday's gap lower open and Friday's trading action, it appears we are seeing a new inverse head and shoulders setup which is similar to the one that played out in late June.

For these two reasons, next week we will be watching closely for a move above last week's high at S&P 1974 or move below last week's low at S&P 1952 as an indication to where we are headed next. A move above the high will set the stage for a rally back up and through the recent high. However, a break below the low will likely push us down to the June 26th low and complete this head pattern. Remember, overall probabilities still favor an upside resolution given the overall uptrend. -Charles Kirk of The Kirk Report

The Bottom Line: We expected to see some post target consolidation last week and that’s exactly what happened. Unfortunately, right now we have no bullish or bearish setups in motion to trade, but a couple of things to watch next week with emphasis on any move above or below last week’s high and low. Overall probabilities still favor the bulls given the dominant uptrends and the three unfilled gaps from last week. -The Kirk Report

Re: 07/12/2014 Weekend Update

Posted: Sat Jul 12, 2014 3:37 pm

by Al_Dente

Banks lag

especially the eurobanks

some domestics appear to be testing double-bottom support

60 min, RSI(14), MA(50)

the weakest link is still domestic small caps IWM (not pictured here)

European rebound? Not yet

Re: 07/12/2014 Weekend Update

Posted: Sat Jul 12, 2014 5:37 pm

by DellGriffith

Daily SPY is going to reach 20 months without touching its 200 dma, which WILL set a new record!

Mid-December 1995-Mid-July 1996: 19 months

October 1992-March 1994: 17 months

April 2003-July 2004: 15 months

September 1996-October 1997:14 months

Re: 07/12/2014 Weekend Update

Posted: Sat Jul 12, 2014 8:10 pm

by jademann

And even if it starts heading down it will take 1-2 months!

http://finance.yahoo.com/echarts?s=SPY+ ... Y;range=1y

Re: 07/12/2014 Weekend Update

Posted: Sun Jul 13, 2014 2:08 am

by uempel

Re: 07/12/2014 Weekend Update

Posted: Sun Jul 13, 2014 3:22 pm

by BullBear52x

Re: 07/12/2014 Weekend Update

Posted: Sun Jul 13, 2014 3:33 pm

by BullBear52x

GLD is bullish, looks like a challenge to 130.5 will be a tough one to break, if it can make it out this time it will be a home run for GOLD bulls.

intraday level is bearish bias but 127.5 should give it a good support for now.

Re: 07/12/2014 Weekend Update

Posted: Sun Jul 13, 2014 4:23 pm

by jademann

The Number Of Businesses That Are Raising Prices Is Surging

http://www.businessinsider.com/selling-prices-2014-7

Re: 07/12/2014 Weekend Update

Posted: Sun Jul 13, 2014 4:35 pm

by tomsky

Hello everybody. Several ideas for the weekend:

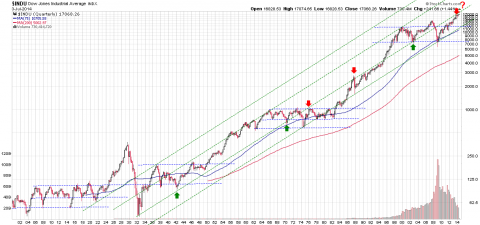

This week we might get a major top per Bradley

Resistance above?

- from here: http://tfaat.blogspot.ro/2014/07/indu.html

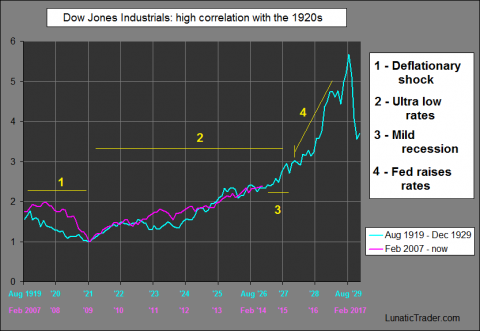

Are we in the middle of the greatest bull run of this century?

- from here: http://lunatictrader.wordpress.com/2014/07/07/deja-vu-in-the-sp-500/

Re: 07/12/2014 Weekend Update

Posted: Sun Jul 13, 2014 7:04 pm

by uempel

Al_Dente's link: This is from the JPM publication, here an excerpt showing US earnings per share (and European earnings too)

US looks great - but note that it's earnings per share and not "earnings" or "revenue".

Companies are buying back shares with cheap money borrowed at artificially low rates - and as a result EPS are shooting to the sky. The mischievous game works as long as the rates stay (artificially) low, but when rates rise the scheme backfires. This is not going to happen tomorrow nor in a few months, but on the long run this set-up appears very, very hollow.

Re: 07/12/2014 Weekend Update

Posted: Sun Jul 13, 2014 7:07 pm

by gappy

Are we in the middle of the greatest bull run of this century?

dow2010vs1920_upd31.png

[/quote]

No Tomsky, this is just the start.

pb.PNG

http://www.prudentbear.com/2014/07/2014-vs-2007.html

Re: 07/12/2014 Weekend Update

Posted: Sun Jul 13, 2014 7:11 pm

by gappy

Old friend of Cobra's:

a.PNG