Page 1 of 1

03/11/2017 Weekend Update

Posted: Fri Mar 10, 2017 5:38 pm

by Cobra

No COT update this week (don't know why), so no smart money chart.

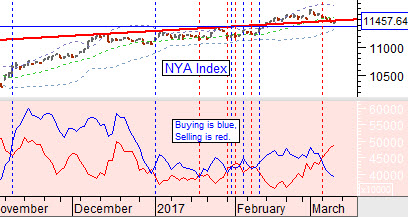

The institutional buy and sell chart from stocktiming however shows the distribution already is more than accumulation despite the market wasn't down much. interesting.

- inst b sell.jpg (59.41 KiB) Viewed 5927 times

Re: 03/11/2017 Weekend Update

Posted: Fri Mar 10, 2017 5:40 pm

by Cobra

don't forget our weekly sentiment poll here:

viewtopic.php?f=9&t=2388

Re: 03/11/2017 Weekend Update

Posted: Fri Mar 10, 2017 6:18 pm

by Al_Dente

His “short-term stock-market-timing model is the best I’ve seen in my four decades of monitoring the investment-advisory industry.“ [Mark Hulbert]

“Sam Eisenstadt … correctly predicted the past six months’ market performance” [let’s face it: few others did]... His outlook for the next six months is:

http://www.marketwatch.com/story/sam-ei ... op_stories

Re: 03/11/2017 Weekend Update

Posted: Fri Mar 10, 2017 7:19 pm

by Cobra

The next week's stock picks are here:

viewtopic.php?f=10&t=2391

Re: 03/11/2017 Weekend Update

Posted: Fri Mar 10, 2017 8:23 pm

by Al_Dente

Friday’s ATH in semiconductors ($SOX, SMH) is important because historically semis are known as leaders or a “frontrunning” indicator, and since the election, semis have lived up to that reputation.

And the NFP data on construction jobs is probably why the homebuilders (XHB) brokeout to a fresh high (but not ATH).

And the healthcare ATH is probably due to Congress remembering who funds them …

And although the 10yr yield ($TNX, TBT) turned away at the double top near 26 (2.6% yield), I expect it to break soon (box formation, my favorite)

Zerohedge noted every single item that is “crashing” [their favorite word], like junk, copper, oil, treasurys, emerging, etc. “Small Caps suffered the worst week since September... This was The Dow's worst week of 2017.”

But do they ever mention anything showing strength? Nooooooooo….

Re: 03/11/2017 Weekend Update

Posted: Sat Mar 11, 2017 10:43 am

by Trades with cats

I prefer to read the Zerohedge twitter feed. That way I ignore the 80% or so of their stuff that is either doom and gloom newsletter come ons or better yet prepper click bate. We had a really harsh winter, most snow since pen and ink came to this valley during the Oregon Trail days. Wall Street Journal delivery was severely interrupted and we didn't miss it so we have cancelled. Could be we are better off knowing we are uninformed rather than being unknowingly miss-informed. Tough call either way.

My dad did well (beating the indexes) for 25 years by simply being informed and buying what seemed like good ideas. His three tools were the Wall Street Journal, Forbes and his broker. Those days are long gone.

Re: 03/11/2017 Weekend Update

Posted: Sat Mar 11, 2017 11:14 am

by Trades with cats

Article here

http://www.zerohedge.com/news/2017-03-1 ... nge-owners

So huge volume, mostly two way. It isn't an easy trade anymore.

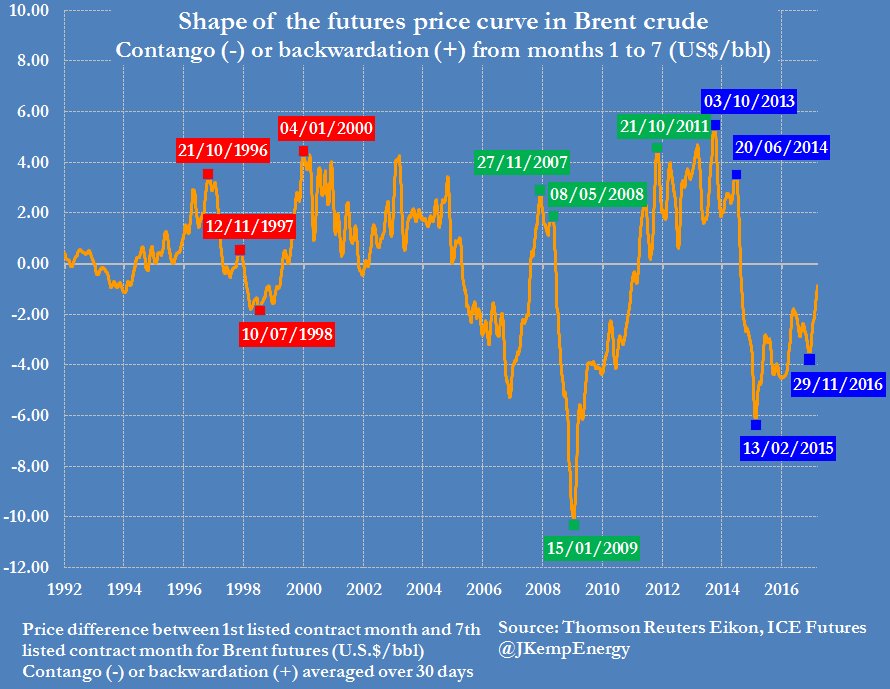

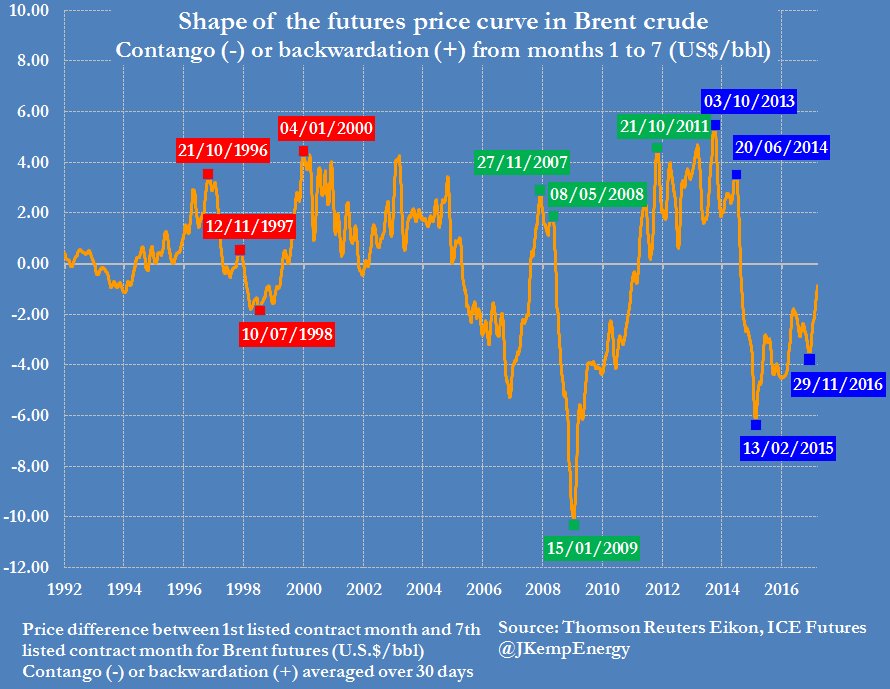

Is OPEC making progress? According to John Kemp yes they are but at a much slower pace than they expected.

So we wait for inventory reports over the next couple of weeks. It really is turning into "Trading Places" with oil substituting for orange juice.

Re: 03/11/2017 Weekend Update

Posted: Sat Mar 11, 2017 2:15 pm

by TraderJoe

Re: 03/11/2017 Weekend Update

Posted: Sat Mar 11, 2017 4:50 pm

by Shaishen

Al_Dente wrote:His “short-term stock-market-timing model is the best I’ve seen in my four decades of monitoring the investment-advisory industry.“ [Mark Hulbert]

“Sam Eisenstadt … correctly predicted the past six months’ market performance” [let’s face it: few others did]... His outlook for the next six months is:

http://www.marketwatch.com/story/sam-ei ... op_stories

Interesting but difficult to take advantage of this prediction, at least for me. Target basically where we are now. Until August wide swings could happen..or not. Respect for Mr Eisenstadt's track record but my simple mind can't identify an edge.

"Eisenstadt’s latest forecast is that the S&P 500 will be trading at 2,370 at the end of this coming August....

... Eisenstadt’s model doesn’t forecast the path the market will take over the next six months. So there is more than one way for the market to live up to the forecast. It could be that stocks rise in a final blow-off to much higher levels in the next couple of months, for example, only to give it all back by the end of the summer. Or it could be that equities remain in a tight trading range for the next six months..."

.

Re: 03/11/2017 Weekend Update

Posted: Sun Mar 12, 2017 11:57 am

by tsf

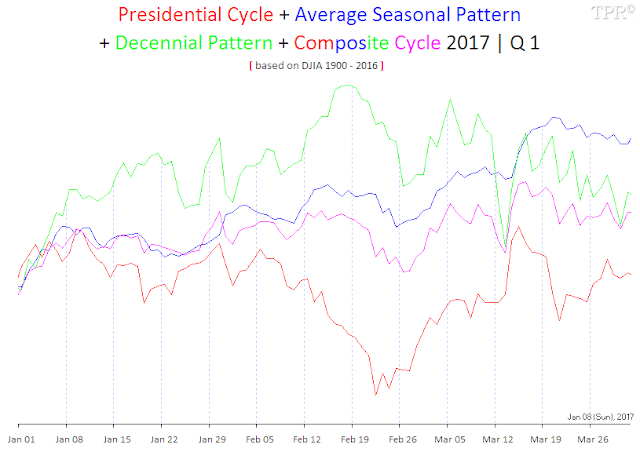

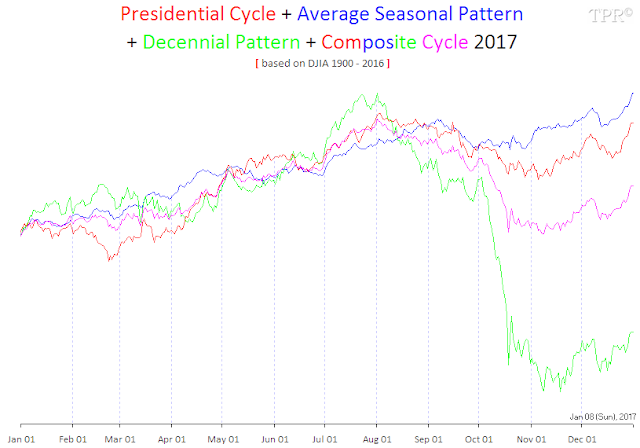

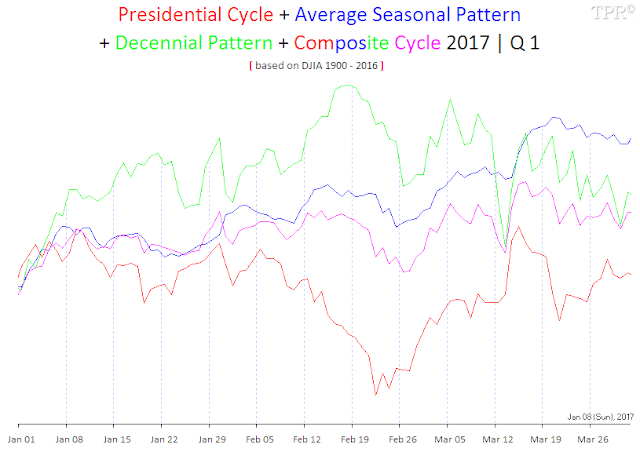

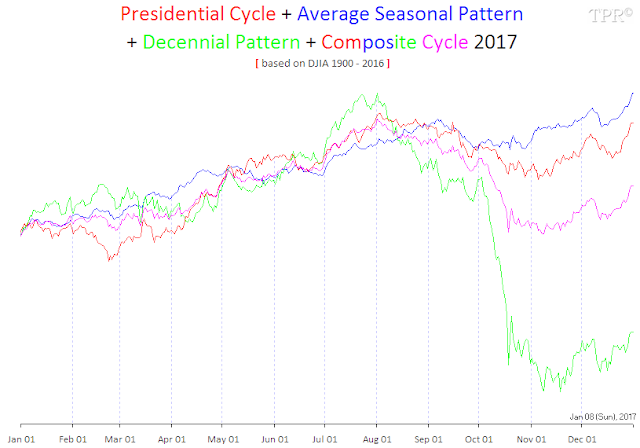

Source: Time Price Research

Re: 03/11/2017 Weekend Update

Posted: Sun Mar 12, 2017 4:09 pm

by Al_Dente

This may interest SMALLS people:

The bottom panels compare the breadth on SML (cyan, S&P 600 small-cap stocks) to the same measures on SPX (purple)

Daily

Re: 03/11/2017 Weekend Update

Posted: Sun Mar 12, 2017 4:09 pm

by Al_Dente

[Stock Traders Almanac]

March OPEX week up 67% of the last 34 years.

The following week down 70% of the time.

https://pbs.twimg.com/media/C6qbEztU8AAB4rj.jpg

Re: 03/11/2017 Weekend Update

Posted: Sun Mar 12, 2017 6:39 pm

by user13

Has anyone had lag issues with the new stock charts annotations?