Page 1 of 3

06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 12:02 pm

by Cobra

my living area had a power failure this morning until now, so sorry for the later thread. The good news is today the market is closed.

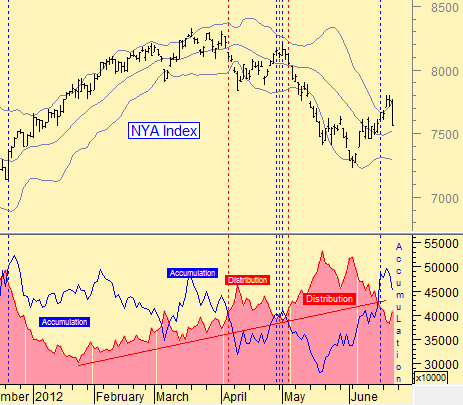

From stocktiming charts, I didn't see anything worth blah blah on institutional accumulation and distribution, but his Algo chart clearly shows the market is still in an overbought area, so even if the market was bottomed Thursday, I doubt how high the market could rebound from this overbought area.

- 2.png (18.68 KiB) Viewed 7011 times

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 12:06 pm

by Cobra

Nothing worth blah blah on II and AAII.

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 12:07 pm

by Cobra

Smart money increased short positions. This is a bad news.

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 12:23 pm

by Cobra

Again, I don't understand why Schaeffer is always bullish. According to their recent Monday Morning Outlook, the chart below is very very bullish as we're about to repeat 2009 bull market again because the buy to open put call ratio is almost at 2009 highs. But if you simply draw a doted red line on that 2009 high, you can see the bottom was still 2 months away! I don't mean in our current case, the bottom would be 2 month away, I just mean I cannot simply get whatever conclusion they draw from the chart below.

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 12:25 pm

by wayne0708

Cobra: Thanks for the weekend effort!

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 12:30 pm

by xfradnex

Daily Elders. Added XLY/XLP, DIA/SPY, and QQEW/QQQ ratio. Hopefully Dr Al can provide some input into some other new ratio combos.

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 12:35 pm

by CH37

Cobra wrote:Smart money increased short positions. This is a bad news.

Happy Dragon-boat Festival , Master Cobra .

From this chart , I did not see any edge about smart money's position .

How do you view this chart ?

Thanks .

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 12:44 pm

by KeiZai

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 12:51 pm

by mmk980

Looks bullish to me.

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 1:01 pm

by KeiZai

Some updates on long-term trades

TIF:

viewtopic.php?f=2&t=553&p=76935#p76935

-my LT target is still ~31

CVX:

viewtopic.php?f=2&t=491&p=67338#p67338

- in clear downtrend channel

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 1:11 pm

by KeiZai

Spy stopped at 20SMA and formed shooting star (weekly)

Dollar looks strong, biased to move higher but WTF is this ??

Astro dates

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 1:17 pm

by ocassional observer

shades of june 2010 continues:

we got the higher high, the reversal and the red close. so far 3 out of 3 weeks looks similar. however, it seems that this time the selling isn't as hard as then. on the other side, vix is way too benign to be calling a real bottom and sentiment indices are also far from being bearish enough. another important factor to watch is the dollar trying to break from it's 10 years decline:

this should weigh on risk assets and commodities especially but will be beneficial for consumers and producers in the us.

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 2:06 pm

by Cobra

CH37 wrote:Cobra wrote:Smart money increased short positions. This is a bad news.

Happy Dragon-boat Festival , Master Cobra .

From this chart , I did not see any edge about smart money's position .

How do you view this chart ?

Thanks .

extreme low readings usually means market top. we're not extreme enough so I just say it's a bad news.

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 2:07 pm

by JTrader

It does appear bullish, but I think we may need to see back beyond 2009 (mega-bull run) to make a fair assessment.

mmk980 wrote:

Looks bullish to me.

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 2:34 pm

by SWalsh

Cobra wrote:my living area had a power failure this morning until now, so sorry for the later thread. The good news is today the market is closed.

From stocktiming charts, I didn't see anything worth blah blah on institutional accumulation and distribution, but his Algo chart clearly shows the market is still in an overbought area, so even if the market was bottomed Thursday, I doubt how high the market could rebound from this overbought area.

An oscillator used by the HFTAlert guy has extremes of +/- 10,000. It reached -10,000 before the recent rally and just shy of +10,000 on Wednesday. I don't know how it is constructed other than to say it does not use price. The only other option then must be, I think, a calculation of volume. But it might use the HFT/Algo activity itself in there also. He will not reveal it's components. He has only stated that going against it at these extremes has proven to be a bad idea. It was at/near -10,000 at the Oct low and December low.

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 2:40 pm

by SWalsh

I received a PM from someone around noon but I can't reply to your question as you do not have PM enabled.

If you are reading this I'd like to reply to your question but you need to check your settings to allow private messages to come in.

Best of luck in you endeavor, either way.

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 3:14 pm

by lazytrader

OEX put/call ratio has been increasing last three days... boys are bearish

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 4:29 pm

by Al_Dente

xfradnex wrote:Daily Elders. Added XLY/XLP, DIA/SPY, and QQEW/QQQ ratio. Hopefully Dr Al can provide some input into some other new ratio combos.

Xfrandex: Great great XLY:XLP elders ratio. My intermediate-term XLY:XLP ratio held that lousy green up-trend line again, but your shorter-term elders show it creeping from green into blue and red.

$OEX:SPY is a good one, as movement into large caps (OEX 100) typically indicates fear and bear (like now), but at some point the spike is excessive and it becomes a bottom/bounce signal… not sure how your elders would handle that (?)

Another helpful ratio, especially now, is GDX:GLD which measures the strength of the mining stocks compared to physical gold.

And the ratio that tracks the contra-cyclical dollar up = gold-and-commodities down “rule”: $GOLD:$USD might be useful (or GLD:UUP only as a second choice)

Obviously an oil-to-something ratio would be timely, as oil is a such an important proxy for inflationary, pardon, deflationary expectations, but at the moment I don’t have one for you ….. maybe keizai has a killer “oil-to-something” ratio he could suggest

I use high-yield bonds to corporate-bonds ratio HYG:LQD to gauge the strength of junk (risk-on) compared to the “””safer””” corporates.

Translated into your elders: a short term green elder reading would indicate strength in risk-on junk, and reds would be the opposite.

HYG is important as when the bond market smells bear-spy, they

usually exit junk bonds first, fast, and in droves (but not at the moment !!).

Perhaps an alternative bond ratio would be better, maybe junk to treasurys… Kezai has one, plus he has other great risk-on/risk-off ratios;

hopefully he’ll pop in here…

Just my 2 cents ….. keep up the good work

An oldie for you….

http://www.youtube.com/watch?v=PSNPpssr ... re=related

ps have to study QQEW/QQQ ratio, that’s an original....fresh.... On a related note, how about an AAPL-to-something ratio

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 4:33 pm

by Al_Dente

For the bulls:

Ned Davis Research on the Consumer Discretionary sector, updated yesterday 6/22/12

http://screencast.com/t/OtA4WhrKq2Rv

Ned on the Information Technology sector, yesterday

http://screencast.com/t/28P8sHaQ

Those two sectors plus healthcare are the only sectors he is “overweight”

For the bears:

A reminder: We are still operating under the venerable “Dow Theory” primary bear market signal of 5/17/12.

One thing we know for sure: it has never in 102 years gone straight down without bounces, traps, head-fakes, confusion and mayhem…….

Re: 06/23/2012 Weekend Update

Posted: Sat Jun 23, 2012 4:45 pm

by CH37

Cobra wrote:CH37 wrote:Cobra wrote:Smart money increased short positions. This is a bad news.

Happy Dragon-boat Festival , Master Cobra .

From this chart , I did not see any edge about smart money's position .

How do you view this chart ?

Thanks .

extreme low readings usually means market top. we're not extreme enough so I just say it's a bad news.

Got it. Thanks